QuickBooks was developed to make the complete accounting and bookkeeping process for small to medium-scale businesses effective and accurate. You can live-track your company’s confidential account and manage them with one powerful application. QuickBooks payroll service is one of the most used features in QB. It records and pays all your employees’ salaries, calculates and files the taxes, and plays the role of a bookkeeping expert, too. What more can you ask for?

Moreover, with QuickBooks, you can withhold taxes from your employees’ salaries and wages depending on eligibility criteria. But, sometimes, even after meeting the requirements, you might encounter the QuickBooks payroll not withholding taxes issue. Therefore, if your QuickBooks desktop payroll not withholding taxes from an employee’s salary, do check the order of the payroll items on the paycheck, which directly affects the calculation.

Additionally, if you eagerly want to rectify the mistakes that triggered this issue, first know the reasons for it. Read this detailed article and learn why QuickBooks is not calculating payroll taxes and the troubleshooting techniques to eliminate the issue.

We indeed understand how frustrating this issue is for many QuickBooks users, including you. The root cause of this problem is the continuous changing of income tax laws. If you want to apprehend about coping with the latest federal and state tax law modifications and simultaneously maintain the QB payroll setup status, then contact us at +1-(855)-955-1942.

What is QuickBooks Payroll Not withholding Taxes?

Sometimes in QuickBooks, you or your employees may notice that the federal or state tax for the duration is 0.0. Or say the state withholding on the paycheck is not at all calculated by QuickBooks. In such cases, you may face the QuickBooks Payroll Not withholding Taxes issue and can get confused about how to deal with it. But do not worry; this is quite common if your employee does not have enough wages to meet the maximum threshold value.

However, if you want to deduct the withholding taxes from your employee’s paycheck, just follow the quick fix given in the next part of the article.

But first, understand exactly why did you face the QuickBooks Payroll Not Withholding Taxes State Taxes issue.

Why do you face the QuickBooks Desktop Payroll Not Withholding Taxes Issue?

There can be several reasons why is your QB Payroll not withholding taxes or the payroll taxes are not calculating in your QB. We have discussed some of these reasons below:

- Your total annual salary exceeds the salary limit.

- The gross wages of the employee’s last payroll are very low.

- You have an outdated QuickBooks Payroll tax table.

- Your QuickBooks software has not been updated timely.

To know in detail how to update the payroll tax table, you can follow QuickBooks Payroll Tax Table Update.

How to Ensure the Employee’s Eligibility for Withholding Taxes?

You and your employees may find that the balance for the federal or state withholding on the paychecks is zero. It mainly happens when you save the payroll before downloading a payroll update and editing an employee’s tax details, causing the taxes to calculate incorrectly or zero. It is absolutely fine if the salary or wages of the particular employee are less than the minimum threshold or the employee claim is exempt. However, if QuickBooks not calculating payroll taxes and you or the employee think that you need to deduct the withholding taxes from the wages. In that case, a few crucial things need to be considered to be sure.

Verifying the Forms for Federal and State withholding of the Employee

Every employee must fill out the federal W-4 and state withholding equivalent form, as after filling out the forms, all the vital information must be entered in the QuickBooks application.

Correctly and timely entering details in the W-4 forms helps with Federal Income Tax calculations on the paychecks. So, the tax calculations depend on some factors like:

- Salary or wages of the employee.

- Time gap or how often the employee gets the paycheck.

- Employee’s marital status.

- How many dependents are in the employee’s family?

- Whether there is any other source of income or not.

Do Check and Verify the Tax Setup

You can check the setup of the tax status under the payroll information tab. After entering all the information in the W-4 form, you must double-check the filing status and that all the fields match with the Employee’s W-4 form details. Now, in case the status for that specific employee is set to exempt or do not withhold, there will be no deduction of withholding taxes from the paycheck. Here, the gross wages will not matter. You can make modifications to the filing status to change the status when the QuickBooks payroll is not withholding state taxes or federal taxes.

Apply 5 Powerful Solutions to Rectify the Problems when QuickBooks is Not Calculating Payroll Taxes

The following are the troubleshooting methods that you should consider if you want to get rid of the withholding tax issues of company employees seamlessly.

1st Solution: For Windows OS, Update Your QB Program to the Recent Release

- Start by opening your QB application on your desktop.

- Now, from the QB application, go to the Help menu from the taskbar on the top.

- Then, choose the option for Update QuickBooks Desktop and then click on Update Now.

- From the Update Now window, choose Get Updates.

- After the updates are downloaded, exit from the QB program.

- Proceed to choose Yes on the confirmation message to install the updates.

Now, as you updated the QuickBooks Desktop in the next step, you must start downloading the recent tax table. You can only get the tax table updates if your payroll subscription is active. In case the subscription is inactivated or expired, you can’t perform the next troubleshooting solution.

Related Post – Struggling with Adding Employees to QuickBooks payroll? Read how to Add Employee to QuickBooks payroll.

2nd Solution: Keep the Payroll Tax-table Up to Date

If QuickBooks is not calculating payroll taxes, that is because the tax table is not updated properly. It does not show precise calculations and rates for federal and state taxes, tax forms, e-filling, and e-paying.

Step 1: If you want to know the version of your tax table

- In QB, go to the Employees menu, and under it, choose Get Payroll Updates.

- Now, you will find the number beside your tax table version.

- Further, in the latest payroll news and updates, you can find if the version is correct or not.

- Then, choose the Payroll Update Information option to get additional details on the version.

Step 2: Getting the new tax table update

- If the tax table version is not new, you can download fresh updates by clicking on the Employees Tab.

- Then, click on Get Payroll Updates and then select the option of Download Entire Update.

- At last, choose Update and you will get an informational window on the screen after the download process is completed.

3rd Solution: Check your Employee’s Payroll Information and Verify if it is correct

- For this, first, go to the Employee menu.

- Next, in the Employee menu, choose the Employee Center option.

- Now, click twice on the employee’s name. (Remember to click one at a time).

- After that, go to the Payroll Info option at the left.

- Then, make sure that the Pay Frequency is correctly set.

- Then, click on the Taxes button.

- And in the Federal tab, review the Filing Status and Allowances fields. Make the corrections if necessary.

- Lastly, you need to click OK twice.

Note: Coming across QuickBooks Error 15276 while updating payroll? To check how can you resolve QuickBooks Error 15276.

4th Solution: Revert your Employee’s paycheck to refresh your payroll information and calculate the taxes.

- For state, navigate to the Employees tab in the application.

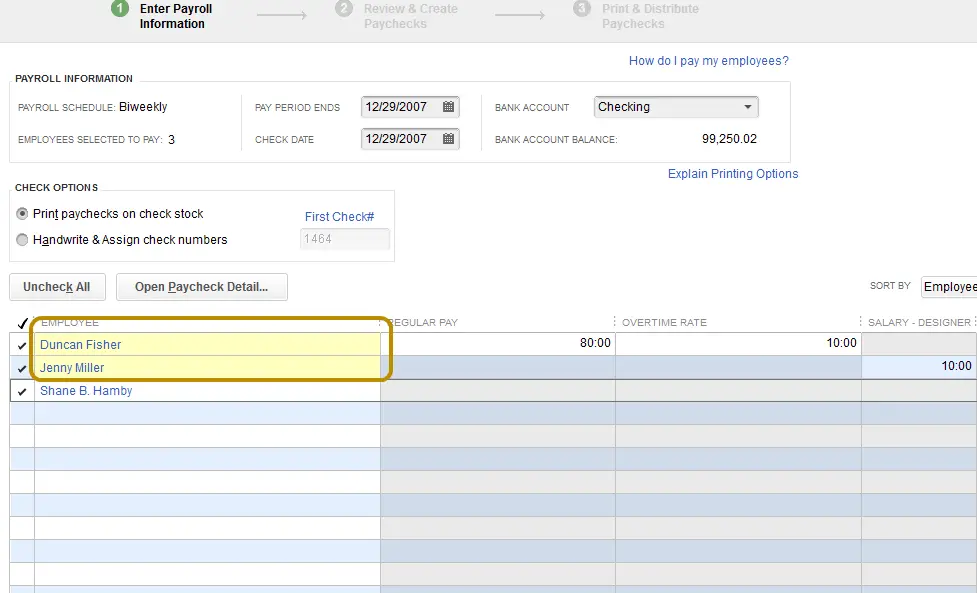

- Then, proceed to choose the Pay Employees option and select the option to Scheduled Payroll.

- Further, choose Resume Scheduled Payroll.

- Afterward, you should right-click on the name of the particular employee you want to undo the changes for.

- After that, select the Revert Paycheck option.

Note: The Revert Paycheck option will only be seen if you have the employee’s name highlighted in yellow. It actually means that you initially started to enter the payroll information but haven’t completed it yet.

5th Solution: Verify If You Have Set the W-4 Status Correctly

Sometimes, when you download the latest payroll tax table updates, it still does not resolve the issue. Therefore, chances are that QuickBooks desktop payroll not withholding taxes is because you mistakenly set the W-4 status to ‘Do Not Withhold.’ To verify if any specific employees are set on Do Not Withhold (Exempt), follow the steps below:

- As you choose the Employees tab, click on the Employee Center option under it.

- Now, double-click on the Employee name whom you want to verify the status for.

- Then, click on the Payroll Info tab and choose the Taxes option.

- Lastly, double-check the details of the Federal and State tab from the Filing Status.

Conclusion

We truly hope that after going through this article, you have grasped the knowledge to eradicate the problem of QuickBooks payroll not withholding taxes. We tried our best to furnish you with essential information in relation to comprehending what might make this issue pop up. However, if you need any information or help in implementing the methods mentioned above, call us at the +1-(855)-955-1942. Get in touch with the support team and let them take charge.

Frequently Asked Questions

The reasons why your QuickBooks payroll does not withhold taxes include the following:

1. Your total annual salary exceeds the salary limit.

2. The gross wages of the employee’s last payroll are very low.

The factors that help in calculating federal taxes are as follows:

1. Taxable wages

2. Pay frequency

3. Number of allowances/dependents

4. Filing status

Ans: You need to give attention to the following factors and carefully eliminate them.

1. If you create fresh payroll data, even if you have already created or entered it before. So, QuickBooks considers these entries duplicated and does not further calculate the taxes and deductions.

2. Another reason is that you over-calculated the taxes in the previous payroll or within the tax quarter.

3. If you see zero balance or even calculated taxes incorrectly for the federal or state withholding taxes, it might be because you saved the payroll before you downloaded the latest payroll update, reworked an employee’s tax information, or edited tax rates.

Ans: There are multiple ways to help you resolve problems when federal or state taxes are not deducted from the employee’s paycheck.

1. Updating your QuickBooks Desktop Program.

2. Downloading the latest updates from the payroll tax table. (Only when your payroll service subscription is active).

3. Again, verify the employee’s payroll details.

4. Reverting the paychecks.

5. Verifying the information in the W-4 tax forms

Ans: An employer deducts a part of the employee’s salary or wages from the paycheck that is paid to the government in the form of taxes. Now, if you do not deduct the amount from the paycheck even when the employee comes under the minimum threshold due to some issue, it ultimately gives rise to QuickBooks payroll is not withholding state taxes issue.