Payroll is a highly crucial function for every modern business enterprise, and accurate tax deductions are essential. However, there may be times when you find QuickBooks payroll not deducting taxes. Consequently, you won’t be able to carry out essential payroll operations.

When QuickBooks payroll doesn’t deduct taxes, it can lead to issues such as failure to adhere to updated tax regulations, delayed or incomplete tax payments, financial penalties, employee discontent, and damage to the enterprise’s reputation. But don’t worry—this extensive guide provides clear and practical solutions to help you resolve the issue quickly.

So, let’s dive into the article and explore why QuickBooks may not automatically deduct payroll taxes and how to troubleshoot the problem efficiently.

This guide will help you ensure accurate tax deductions through QuickBooks payroll. However, if you want to fix this issue faster and need personalized guidance, dial +1-(855)-955-1942 to contact a QB professional.

Why Does QuickBooks Desktop Payroll Fail to Deduct Taxes?

Here are the relevant factors that might trigger QuickBooks payroll not deducting taxes:

- It is possible that the employee’s wages have exceeded the applicable tax wage base.

- Failure to download and install the current payroll tax table updates will likely result in paycheck processing errors.

- The presence of duplicate payroll tax items can lead to either under-deduction or over-deduction of payroll taxes, thereby creating potential complications.

- Inaccurate tax withholding configurations for individual employees will generate errors in payroll tax calculations.

- Using an outdated QuickBooks Desktop application can lead to compatibility issues with Windows, resulting in various errors.

- Incorrect payroll items and employee tax settings can cause issues when generating paychecks and calculating payroll taxes.

- The employee’s total earnings may be insufficient for tax deductions.

- Corrupt company data is another key factor that can cause issues when processing QuickBooks payroll.

Now that you know about the common causes of this problem, let’s jump to the following section to discover detailed resolutions for it.

9 Things to Do If QuickBooks Payroll Not Deducting Taxes

Here are the troubleshooting methods that you can utilize each time you find QuickBooks payroll not deducting taxes. Ensure that you implement these solutions in the exact sequence as set out below.

1. Install QuickBooks Desktop Application Updates

An outdated QuickBooks application can be a significant factor behind QB payroll not taking out taxes. It is well-known that QB updates always bring fresh features, utilities, and other technical improvements. Once you install QuickBooks updates, the software will function more smoothly, allowing you to ensure accurate tax deductions using payroll.

If, however, you still find QuickBooks payroll not deducting taxes, try the following solution.

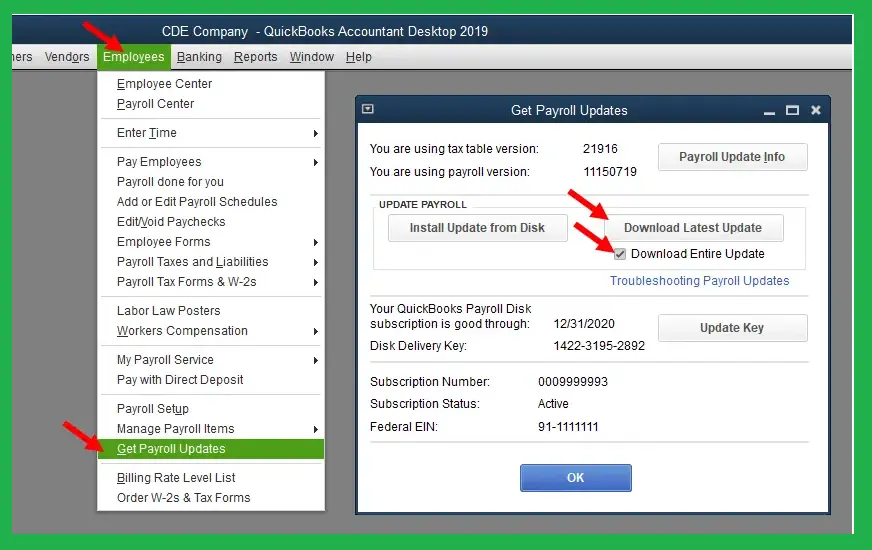

2. Download and Install Payroll Tax Table Updates

Updating QuickBooks payroll tax tables is crucial for maintaining accurate payroll and ensuring compliance with tax regulations. It is a fundamental aspect of responsible payroll management, safeguarding businesses from financial risks. Here’s what you need to do:

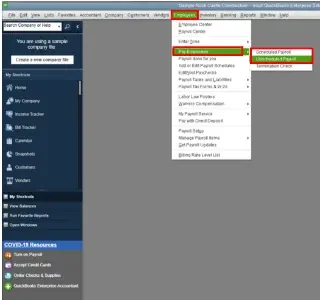

- Launch QuickBooks Desktop and quickly navigate to the Employees menu. Select the Get Payroll Updates tab.

- Click on Download Entire Update, then press Update.

- Allow the payroll tax table updates to be installed completely. If QuickBooks payroll updates fail, troubleshoot the issue before proceeding.

- Once updated, QuickBooks Payroll will accurately calculate all taxes.

Do you still notice QuickBooks payroll not deducting taxes? If that’s the case, consider checking the payroll item configuration as described below.

3. Review the QB Payroll Item Configuration

An incorrect payroll item setup can cause discrepancies in an employee’s paycheck during tax calculations. It’s essential to review the entire payroll item setup to ensure accurate tax deductions. Here’s how to do so:

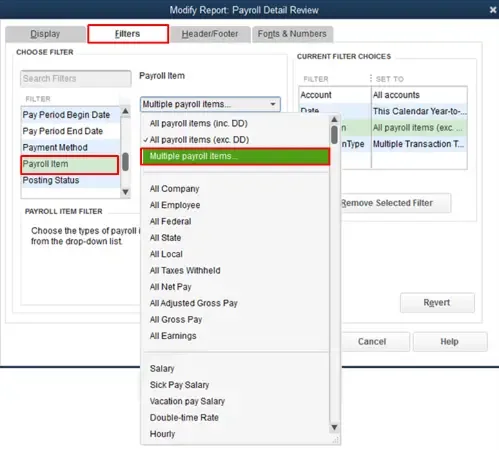

Step I: Generate the Payroll Detail Review Report

The Payroll Detail Review report allows you to verify the accuracy of tax deductions on paychecks. Follow these steps to generate the report:

- Open QuickBooks Desktop and navigate to the Reports menu.

- Select Employees & Payroll, then click Payroll Detail Review.

- Click Customize Report and go to the Display tab.

- Set the date range using the From and To fields.

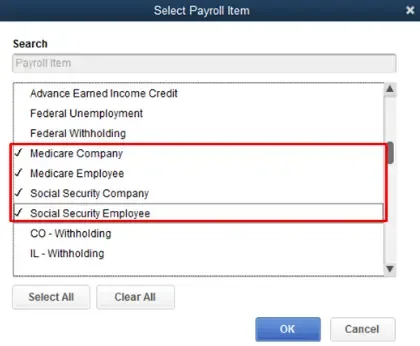

- Switch to the Filters tab and select Payroll Item.

- Choose Multiple Payroll Items and check the relevant taxes that were not deducted.

- Click OK and review whether the paycheck deductions are accurate.

If the payroll items show incorrect deductions, promptly adjust payroll liabilities using the following step.

Step II: Accomplish Payroll Liabilities Adjustment

Adjusting payroll liabilities helps eliminate tax discrepancies and ensures accurate payroll item setup. Follow these steps to make adjustments:

- Open QuickBooks Desktop and select the Employees tab.

- Navigate to Payroll Taxes and Liabilities and click Adjust Payroll Liabilities. If the payroll liabilities option is missing, ensure it is properly configured.

- Use the Date and Effective Date fields to select the relevant paycheck.

- In the Adjustment For section, choose Employee Adjustment to modify the employee’s year-to-date (YTD) information.

- Under Item Name, select the payroll item that needs adjustment.

- Enter the adjustment amount:

- Use a positive amount if the payroll item was under-withheld.

- Use a negative amount if it was over-withheld.

- In the Income Subject to Tax field, input the wage base adjustment amount.

- Add a reference note in the Memo field.

- Click Accounts Affected, then OK.

- Select Affect Liability and Expense Accounts and confirm by clicking OK. Once completed, verify that payroll items are correctly deducted from the employee’s paycheck.

If you continue to find QuickBooks payroll not deducting taxes, consider reloading your employees’ payroll data as outlined below.

Also Read: How to Fix QB Payroll Not Working Error

4. Refresh Your Employee’s Payroll Information

Incorrect tax rates and deductions can prevent QuickBooks Payroll from calculating taxes accurately. To resolve this issue, refresh your employee’s payroll data using the steps outlined below:

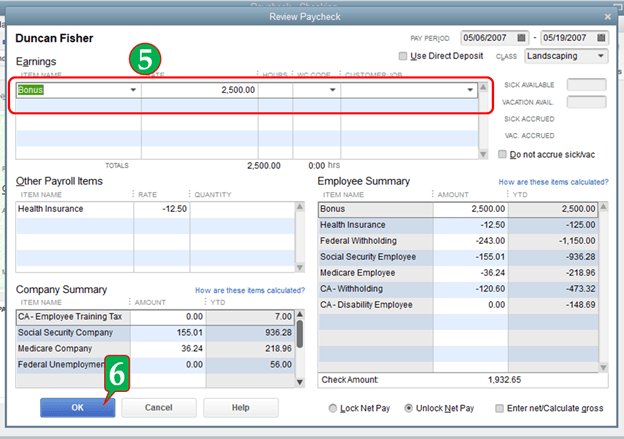

(a) When You Have Not Generated a Paycheck

If you haven’t finalized the paycheck, you can revert it by following these steps:

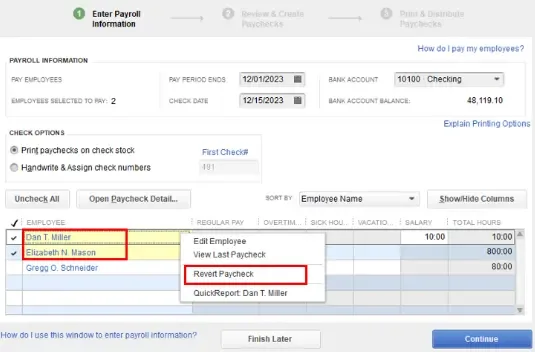

- Open QuickBooks Desktop and go to the Employees menu.

- Select Pay Employees, then click Scheduled Payroll.

- Click Resume Scheduled Payroll to continue.

- Right-click on the employee’s name and select Revert Paychecks to refresh the payroll data.

- Once done, you can accurately recalculate taxes using QuickBooks Payroll.

(b) When You Have Already Issued the Paycheck

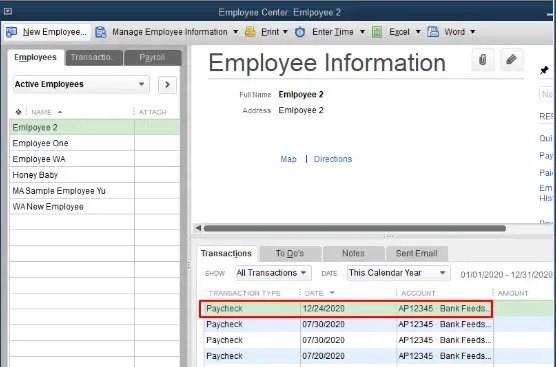

If you have already issued the paycheck, you’ll need to delete it. Follow these steps:

- Open QuickBooks Desktop and navigate to the Banking menu.

- Select Use Register, then choose your bank account.

- Click OK to confirm your selection.

- Locate the relevant paycheck under Employee Information (if payroll taxes weren’t deducted).

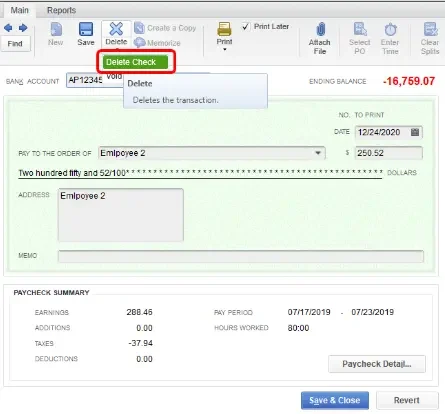

- Open the paycheck and click Delete.

- Confirm by selecting OK to erase the paycheck.

You can now recreate the paycheck with the correct tax details. If QuickBooks payroll still isn’t deducting taxes, review the employee’s tax withholding setup as outlined below.

5. Review the Employee’s Tax Withholding Configuration

Taxes may appear as $0.00 on a paycheck if the employee claims an exemption or if their wages are below the taxable threshold. You can find the minimum tax deduction requirements in the IRS publication and on your state’s tax department website.

If the employee should not be tax-exempt, update their tax filing status with these steps:

- Open QuickBooks Desktop and go to the Employees menu.

- Click Employee Center and select the employee’s name.

- Go to the Payroll Info tab and select Taxes.

- Under the Federal tab, choose the appropriate W-4 form from the dropdown.

- Set the Filing Status to Not Exempt, then switch to the State tab.

- In the Filing Status section, select Not Exempt.

- Click OK to save the changes. Now, QuickBooks Payroll will correctly deduct taxes for the employee.

Do you continue to find QuickBooks payroll not deducting taxes? If so, consider erasing the duplicate payroll tax item, as explained below.

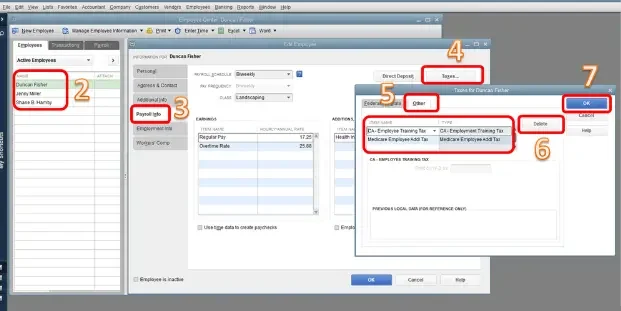

6. Remove the Duplicate Payroll Tax Item

Duplicate payroll tax items can cause imprecise tax deductions and corrupt payroll reports. In some cases, these duplicates may even prevent you from deducting payroll taxes for your employees due to inconsistencies in the payroll data. Once you eliminate the duplicate tax items, you can ensure accurate payroll tax calculations. Here’s how to fix it:

- Open QuickBooks and navigate to the Employees menu.

- Select the Employee Center and double-click on your employee’s name.

- Choose Payroll Info, then select the Taxes option.

- Click on Other to find the duplicate payroll tax item.

- Hit Delete to remove the duplicate, then click OK to save the updated settings.

If you still find QB payroll not withholding taxes, try fixing your company data as mentioned below.

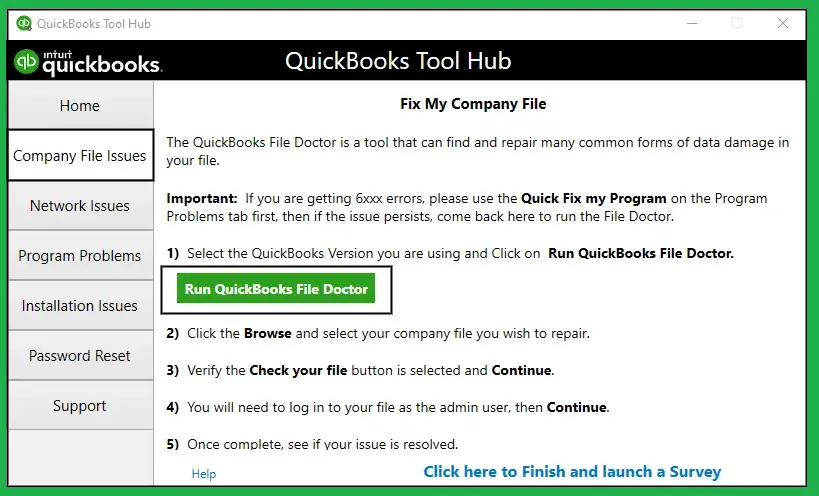

7. Repair Your QB Company Data

Data corruption in the company file will lead to errors in payroll tax deductions. To correct this, run the QuickBooks File Doctor utility, which repairs the file and helps ensure accurate tax calculations. This will also eliminate network problems.

If, however, QuickBooks payroll still fails to deduct taxes properly, check the employee’s tax calculation limits as detailed below.

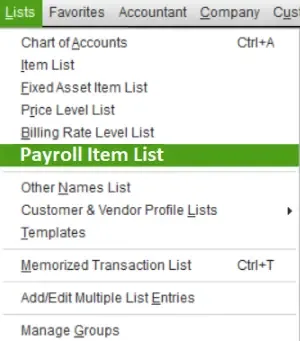

8. Check the Employee’s Tax Calculation Limits

If QuickBooks isn’t calculating employee taxes, the default limit may have been reached. To resolve this, modify the employee’s tax details. Here’s what to do:

- Open QuickBooks Desktop and go to Lists.

- Select Payroll Item List, then right-click the relevant payroll item.

- Choose Edit Payroll Items and click Next until you reach the Limit Type option.

- Ensure the correct option is selected for your employee. There are three options: Annual – Restart Every Year, Monthly – Restart Every Month, and One-Time Limit.

- You can also modify the default Limit Type for the employee if needed.

- Click Finish on the window and then reopen QuickBooks Desktop.

Now, create paychecks for your employees and verify if the payroll taxes are being deducted. If taxes are still not deducted, proceed to the next troubleshooting hack.

9. Check the Employee’s Payroll Tax Setup

Taxes in QuickBooks payroll are calculated based on the payroll data you enter for each employee. Key factors affecting payroll tax calculations include taxable salary and wages, number of dependents, allowances, pay frequency, and filing status. It’s crucial to ensure these factors are correctly entered in QuickBooks payroll. Here’s how to do it:

- Open QuickBooks Desktop and navigate to the Employees menu, then go to the Employee Center.

- Double-click the employee’s name and select Payroll Info.

- Review the Pay Frequency and then go to the Taxes tab.

- Choose the Federal option, then verify the Filing Status and Allowances. Make any necessary corrections in these fields.

- Click OK to save the updated payroll setup.

Finally, you can easily create paychecks for employees and ensure accurate tax deductions.

Best Practices to Ensure Valid Tax Deductions in QB Payroll

Here are some things you can do to ensure accurate tax deductions in QuickBooks payroll:

- Regularly Update Payroll Tax Tables: Always keep your payroll tax tables up-to-date to reflect the latest tax rates and regulations.

- Verify Employee Tax Information: Double-check that each employee’s W-2 and state tax forms are filled out correctly to ensure proper withholding.

- Use Correct Tax Liabilities: Set up the correct tax liabilities (federal, state, and local taxes) for accurate deductions.

- Track Taxable Benefits and Deductions: Ensure that benefits (e.g., health insurance) are correctly classified as taxable or non-taxable in the system.

- Set Up Payroll Items Properly: Correctly configure payroll items for earnings, deductions, and taxes to avoid errors in calculations.

- Run Payroll Reports Regularly: Review payroll reports, like the Payroll Summary and Tax Liability Report, to verify tax calculations.

Wrapping Up

In this detailed guide, we have discussed several resolutions you can implement each time you find QuickBooks payroll not deducting taxes. Hopefully, you can now ensure valid tax deductions for your employees. If, however, you still face challenges or have a query, you can contact a QB professional for instant assistance.

Frequently Asked Questions

A. QuickBooks Payroll may fail to deduct taxes due to incorrect employee tax setup, outdated payroll tables, or improper state settings. Ensuring each employee has the correct filing status, exemptions, and wages entered accurately is crucial. Updating payroll tax tables regularly resolves most discrepancies.

A. First, check that your payroll subscription is active and up to date. Verify employee tax information, including federal, state, and local tax details. Running the payroll update feature in QuickBooks Desktop or Online often resolves calculation errors.

A. Examine each affected employee’s tax setup to confirm filing status, allowances, and exemptions. Some employees may have exemptions or incorrect pay types that bypass certain taxes. Correcting their profiles usually restores proper deductions.

A. Yes. Using outdated QuickBooks Desktop or Online versions can lead to missing payroll tax updates, causing incorrect or missing deductions. Always ensure your QuickBooks version is current and payroll updates are installed.