Intuit ProFile Software is designed to assist users with their tax preparation and e-filing returns. Users may sometimes face problems when using this application due to QuickBooks Error Code 80010. This error arises while e-filing two different forms- Form T1163 and T2125. Self-employed farmers must report their farming activities for a given year through Form T1163. Business, professional, and commission income is required to be reported through T2125. These forms are reported to CRA, and thus any sort of mistake can bring in federal repercussions. Although the error code is the same for both the forms, but the reasons, and the troubleshooting methods are different.

QuickBooks Error Code 80010 can create a hindrance in filing tax forms. If you have run into this error, reach out to an expert, and they can fix it for you. Just call at +1(855)-955-1942.

Case 1: If QuickBooks Error Code 80010 arises while E-Filing Form T2125

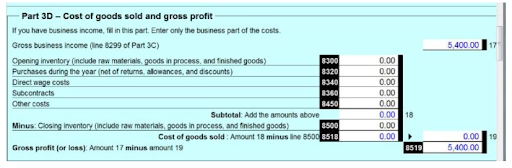

There are specific tax codes attached to every line of your form. Here the line refers to different things that are reported. Error Code 80010 occurs, When the amount entered in line 8500 is greater than what is entered in 8300.

Solution:

8300 code represents the opening inventory and 8500 the closing inventory for a business. You need to check that the amount entered in 8300 is not less than what was entered in line 8500. Verify that the figures on lines 8300 to 8450 are accurate, and that the total exceeds line 8500.

Need help printing QuickBooks Form 941? Head over to our dedicated blog on how to Print QuickBooks Form 941.

Go ahead with the return after cross-checking the values.

NOTE: Pre 2017 T1 return section for T2125 was present in Part 4. After 2017 this section was brought under Part 3D, although it does not change the method to solve it.

Case 2: Error 80010 when E-file Return for T1163 in QuickBooks ProFile

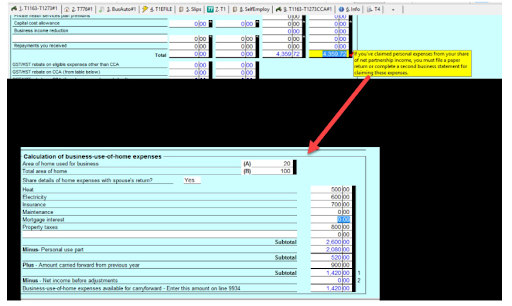

User adding input of business-use-of-home expenses leads to error 80010 when e-file return for T1163 is done with QuickBooks ProFile. Form T1163 is required to be filed by self-employed farmers to record information about their crops, profit and losses.

Solution:

Users are required to either paper file or create a separate form for business-use-of-home expenses if error 80010 arises when e-file returns for T1163.

Execute the process to generate a new T1163 and EFile for business use of home expenses:

- Go to T1163 and take notes of all business-use-of-home expenses.

- Manually remove all the information entered to clear off the fields.

- Now, Go to the Form list in the top toolbar and tap on New Form.

- Now, Enter all the important information.

- Fill in the details about business-use-of-home expenses.

- Now, EFile the return.

NOTE: CRA tends to renumber lines a lot. Go to the CRA guide and check out chapter 2 to ensure the numbers and code of lines.

Allow Experts to help you fix QuickBooks Error Code 80010!

All the Information is mentioned above to fix QuickBooks Error Code 80010. The error arises while filling two different errors. Intuit ProFile can help users out with other tax forms too. If your error is still not resolved and you have no idea what you need to do, reach out to an expert at QuickBooks Data Service Solutions helpline number +1(855)-955-1942.

Related Post:

QuickBooks Tool Hub- Its Components | How to Download & Install

Resolve QuickBooks Error H202 in Minutes: Expert Advice

How To Fix QuickBooks Error PS038 [Payroll Update Error]