There might be an instance where you would want to delete a specific transaction, but your accounting advisor asks you to void it instead. But, due to never-ending human errors, you end up voiding the wrong transaction, and now you need to revert it. Don’t panic! It’s possible to do this. If you ever face such a situation, you must unvoid a check in QuickBooks. Unvoiding a check means undoing the voided check. QuickBooks has no automatic unvoid feature for the paychecks. For that, to find out the exact numbers that were on the paycheck and to redeem them, you need to use the Audit Trail report. However, the detailed steps of un-voiding a Check-In both the desktop and online QuickBooks version have been covered in this blog ahead.

Looking for an easier way to unvoid a paycheck in QuickBooks? Well, if that’s so, you must reach our experts by placing a call on our Toll-Free Number +1(855)-955-1942 and they will guide you in the handiest way possible.

Why Is Voiding Preferred Over Deleting A Check In QuickBooks?

If any user deletes the invoices, he/she will permanently remove them from the company file. And it causes the bills paid to return to unpaid status. On the other hand, if he voids an invoice, it cancels the particular payment or invoice. Thus, voiding keeps the invoice number and lists it in the report but changes its amounts to zero. Hence, if you want to stop a particular payment from being realized by QuickBooks, select void. To remove the receipt from QuickBooks, select delete. If you want to perform both of these actions then first void the transaction and then hit delete. This will stop the payment process as well as remove the receipt from your records.

Different Ways to Unvoid A Check In QuickBooks?

As we have mentioned already, voiding a check makes more accounting sense than deleting it as it sets the amount to zero. Thus, here we have listed the steps on how you can un-void check in QuickBooks Online & Desktop:

- Unvoid a Check in QuickBooks Online

- Unvoid a Check in QuickBooks Desktop

A: Steps To unvoid a Check in QuickBooks Online

As discussed above, there is no automatic way by which you can reinstate a voided transaction. However, if you want to open and view any information for a particular transaction, then you can just re-enter the transaction manually.

- Search and open the voided transaction.

- Then go to the bottom of the page, and then click on the More option followed by Audit History.

- Next, select the Show All option to see the original details of your transaction or any edits made to it and when it was voided.

- Make sure to note down all the information that is required to re-enter the transaction.

Note: Once a transaction has been voided, then the amount on it must always be 0. And you must also use an appropriate amount while re-entering the transaction.

- Then select the back button on your browser, and proceed to re-enter the voided transaction.

Once you have entered the corrected transaction details, your records will get updated accordingly.

B: Here’s How to Unvoid a Check in QuickBooks Desktop

Well, it’s important for you to know that you will not have any option to revert an invoice that is once voided. Instead of that, you can use the Audit Log to see the information and re-enter them.

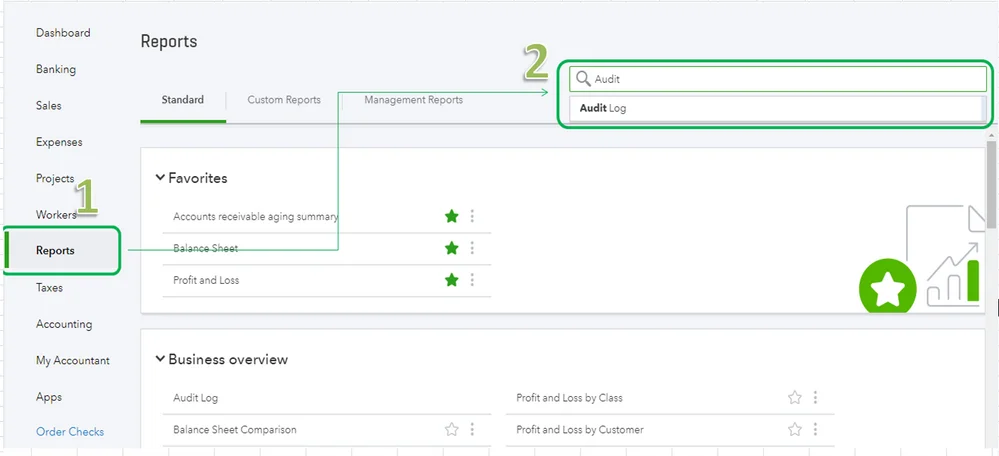

- Open the QuickBooks application and click on the Gear icon.

- Go to Tools and then, select Audit Log.

- Navigate to Filter, and from there, select User Date and Event Filters option. Then, click on Apply.

- Now, search and locate the invoice that has been voided.

- After that, go to the History column and click on View.

- You need to note the information of the transaction from the Audit History and then you can use it while creating a new invoice.

Note: QuickBooks will retrieve the details of the original transaction, When you undo a voided transaction.

- By now You have the voided as well as the newly restored transaction (in the deleted/voided transaction record).

Find An Expert To Un-Void Check In QB!

We hope the above-mentioned steps would have helped you unvoid a check in QuickBooks. However, if you couldn’t follow the listed steps and want an expert to help you do so. Then, we would suggest you getting in touch with our support team. Our professionals will resolve all your QuickBooks related queries in the easiest way without wasting much of your time. To reach us, place a call on QuickBooks Data Service Solutions Helpline Number +1(855)-955-1942.

Frequently Asked Questions

Voiding a check in Quickbooks means that you are canceling a particular payment or invoice in QuickBooks. But keeping the invoice number and listing it in reports, and changing the amounts to zero.

You can not directly unvoid a check in Quickbooks. You can simply open and view most of the information for a transaction and manually re-enter it back.

To unvoid the paycheck in QuickBooks, go to QB and open the menu. Then select the Reports tab and click on the Accounts and Taxes section. Then go to the voided transactions option and look for the transaction you want to unvoid. Now copy the transaction amount and from the Chart of Accounts section, open the Accountant tab. In the Account Register, where all the voided transactions are kept, paste the amount of the original transaction on the voided transaction. Lastly, exit after clicking Save.