Do you keep coming across: [PS077] QuickBooks is having trouble installing your payroll update error message every time you try to get the most recent payroll updates? If yes, this troubleshooting article will help you identify all the underlying causes and solutions to resolve the issue .

QuickBooks error PS077 is part of PSXXX series error codes that arise when you try to download/install the tax table updates. These updates are essential to ensure you get the current and accurate tax rates for the calculation of federal and supported state taxes and payroll tax forms. Therefore, it is crucial to eliminate error code PS077 as quickly as possible. Keep following this guide until the end and become a pro at troubleshooting PS077 Error in QuickBooks Desktop.

If you are past the deadline for paying and filing taxes due to QuickBooks payroll update error PS077, dial +1-(855)-955-1942 and chat with an expert to resolve the problem promptly!! Do not wait any longer to avoid hefty tax penalties by state and federal tax agencies

What are the Reasons Behind QuickBooks Error Code PS077?

The following are the various possible reasons why you’re getting the error message PS077 in QuickBooks Desktop:

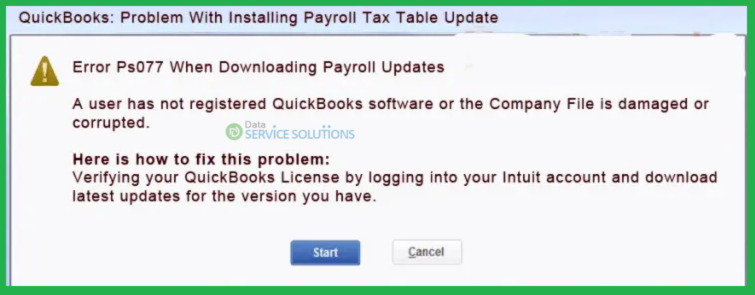

- If the tax table file gets corrupted or there is an invalid component in the payroll folder.

- If the QuickBooks company file is corrupted or damaged, it might trigger QuickBooks error code PS077.

- If you do not have an active subscription to the QuickBooks Desktop program.

- Incorrect or outdated billing info is also a reason for getting payroll update errors like PS077.

- If something goes wrong while installing QB Desktop, you might get the error PS077 while getting the payroll updates.

- When the files in the CPS folder required to update payroll are damaged.

- When the User Account Control on Windows starts blocking payroll updates, you get several update errors, including PS077.

How to Fix QuickBooks Payroll Error PS077 Effortlessly?

Before you implement the methods to isolate error code PS077, we suggest you create a backup of the QB company file. This way, you can restore the company file quickly if you run into issues like data loss while troubleshooting. After successfully creating a backup, implement the solutions mentioned next in the article.

1st Method: Disable the User Account Control in Windows OS

If UAC is turned on, it enhances the security of the system. The motive is to protect the system from external threats and lower the attack surface. But while safeguarding the system, User Account Control can also restrict QuickBooks Desktop from performing specific tasks, like installing QuickBooks payroll updates. Therefore, you must turn off the UAC to fix QuickBooks error PS077. Here are the instructions to avoid restrictions imposed by User Account Control on Windows.

Important Note: To resolve the issue, it is crucial to disable UAC; however, we also strongly recommend you enable it again to protect the system from any future security threats.

- On your keyboard, hit the Windows + R keys together.

- When the Run window appears, type Control Panel in the command box and click OK.

- Click User Accounts and then choose the User Accounts (Classic View) option.

- Click the Change user account control option, and if prompted by UAC, Choose Yes to continue.

- Move the slider, set it to Never Notify, and click OK to turn the UAC OFF.

- Reboot the system to save the changes and try to install the updates.

If turning off the User Account Control does not resolve error code PS077 in QuickBooks, implement the next solution.

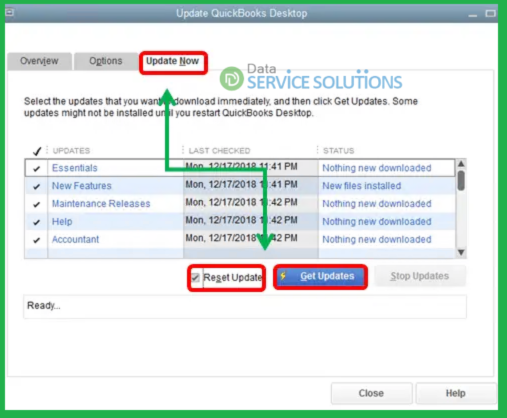

2nd Method: Reset the QuickBooks Software Updates

To rectify QuickBooks update error PS077, you must initially consider updating QuickBooks Desktop to the most recent release, followed by updating payroll. To do so, follow the steps below to reset the QB application updates:

- Close the company file and QuickBooks Desktop.

- Click the Start menu, and in the search box, type ‘QuickBooks Desktop.’

- By right-clicking the QB Desktop icon, choose the Run as Administrator option.

- In the No Company Open Window, click the Help menu and then choose Update QuickBooks Desktop.

- Move to the Options tab.

- Choose Mark All and click Save.

- Move to the Update Now tab.

- Click the checkbox to Reset Update and select the Get Updates option.

- In the pop-up text, click OK.

- Once you reset the update, close and re-open QB.

- On the QuickBooks Update Service, select the Install Now option.

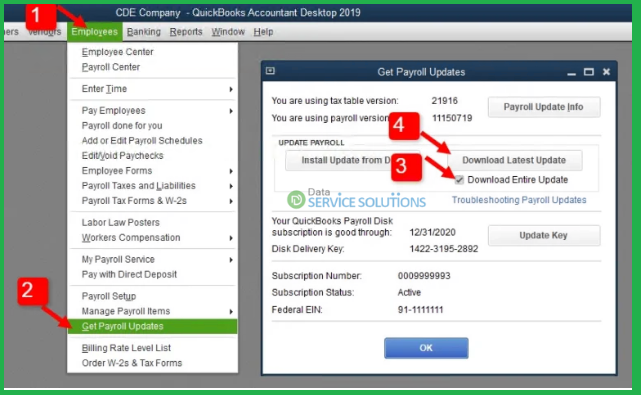

Once you successfully install the QB software update, try to download/install the payroll updates by following the steps given below:

- Move to the Employees tab.

- Click Get Payroll Updates and ensure that you checkmark the Download Entire Update option.

- Select Download Latest Update.

However, even after resetting QuickBooks Desktop updates, if you cannot download the updated tax table, move to the next troubleshooting.

3rd Method: Change the Name of the CPS Folder

Go through the following steps to rename the CPS folder containing the damaged files to fix QuickBooks payroll error PS077:

- Open the File Explorer window by pressing the Windows + E keys together.

- Select This PC and navigate to the Local Disk C.

- Go to the Program Files (x86) folder and then the Intuit folder.

- Double-click and open the QuickBooks folder for your current QB Desktop version.

- Click Components and select the Payroll folder.

- Right-click the CPS folder and select the Rename option from the drop-down menu.

- Enter a new folder name, CPSOLD, and hit Enter.

Try to install the payroll updates again to check if the above solution proves to be effective in fixing QuickBooks error PS077. But if the problem persists, go to the next method.

4th Method: Verify and Rebuild the QuickBooks Company File

QuickBooks company files contain data that is crucial for running payroll updates. Therefore, if the company file is damaged, the QB cannot access that data, and to repair it, you must run the verify and rebuild tool. It is an effective tool to help you eliminate QuickBooks error PS077. To learn how to use it, follow the instructions below:

Step One: Run the Verify Tool in QuickBooks

If there is any damage in the company file, the verify tool will help you detect it. To find the issue in the data, follow the instructions below.

- Open QuickBooks and move to the Window tab.

- Choose Close All.

- Go to the File tab and click Utilities from the drop-down.

- Click the Verify Data option. After the scanning process completes, you will see one of the following messages on the screen:

- If ‘QuickBooks detected no problems with your data’ appears, it means the company file is damage-free, and you might be getting error code PS077 due to some other reason.

- If an unknown error appears, find it on the QuickBooks Desktop support site and proceed accordingly.

- If ‘Your data has lost integrity’ appears, it means there is damage in the file.

Note: If you are an Assisted Payroll user, dial +1-(855)-955-1942 prior to rebuilding the data file.

Step Two: Run the Rebuild Tool in QuickBooks

If you find damage in the company file after verifying, the next step is rebuilding it. Go through the following instructions to use the rebuild tool:

- Go to the File tab and click Utilities from the drop-down list.

- Choose the OK option if QB prompts you to make a backup copy prior to rebuilding the company file. But if you already made a backup, skip it.

- Choose a location on the system to save the backup, then select OK. Also, do not replace the new backup file with another one.

- Name the backup file and select Save.

- Rebuild the data, and when you see the text message ‘Rebuild has completed,’ select OK.

- If you want to re-check the company file for additional damage, Move to the File menu, select Utilities, and then click the Verify Data option.

- If the verify tool finds more damage, you must fix it manually. Go to the QuickBooks Desktop support site after finding the error(s) in the qbwin.log file.

- If no issue is detected, restore a recent backup. Click the File tab and select the Open or Restore Company option.

Important Note: Make sure not to replace the existing company file with the new file. Also, you will need to re-enter the details in the company file since the backup was made.

After following all the steps above, try installing the payroll updates to check if QuickBooks error PS077 is resolved. But if the verify and rebuild tool fails to do it, move to the next method.

5th Method: Repair QuickBooks Desktop with QB Install Diagnostic Tool

In this solution, we will extensively repair the QuickBooks application to fix QuickBooks payroll update error PS077. QuickBooks Install Diagnostic Tool can automatically resolve issues like partial or corrupt installation. You can access this utility from QB Tool Hub. However, if you are going to utilize the QuickBooks Tool Hub for the first time, click Here to download the installation file. Then, follow the procedure below to install Tool Hub on the system.

Important Note: If you have already installed QB Tool Hub on the system, verify if it is the latest version. Go to the Home tab, and the version will appear at the bottom.

Step One: Install the QB Tool Hub on the System

Note: We advise running QuickBooks Tool Hub on Windows 10, 64-bit OS, for best results.

- After downloading the Tool Hub, go to the Downloads folder and open the QuickBooksToolHub.exe file. However, if you manually save the file to a different location, open the file from there to initiate the installation.

- Start following the on-screen instructions in the Tool Hub installation wizard window.

- Go through the License Agreement and agree to all the Terms and Conditions by clicking Agree and Continue.

- If you want to change the location, select a different installation location in the next window and click Next.

- Select the Install option.

Note: If you want to modify or review the settings, click Cancel to exit from the installation wizard.

- As the installation completes, double-click and open the Tool Hub.

Step Two: Run the QB Install Diagnostic Tool

- Go to the menu bar on the left to select the Installation Issues tab and then choose the QB Install Diagnostic Tool option.

- Let the tool run and scan QuickBooks for about twenty minutes.

- When the process ends, reboot the system and then try to download the tax table updates again.

If the Install Diagnostic tool fails to fix QuickBooks payroll error PS077, move to the next troubleshooting solution.

6th Method: Activate the QuickBooks Program

Usually, when you install QuickBooks Desktop on the system, QB then also prompts you to activate it. But if not prompted, you must do it yourself. Follow the instructions below to manually activate QB to resolve the error message PS077 in QuickBooks.

- Launch the QuickBooks application and choose the Help menu.

- Click the option to Activate QuickBooks Desktop and proceed to follow the on-screen instructions to verify the further information.

Try to update the payroll service; if you fail, follow the next method.

7th Method: Update the Billing Info in CAMPS

The following is the procedure to fix the wrong billing details in the CAMPs account to get rid of QB error code PS077

- Visit the Customer Account Management Portal and enter the registered QuickBooks email ID/user ID.

- Search for the subscription in the Products & Services list and choose the Details option.

- Search the payment method in the Billing Information section.

- Select the Edit option.

- Update your information and then click Save and Close.

Conclusion

Hopefully, now you have understood all the reasons and implemented the solutions presented in the article. But, if none of the troubleshooting was useful in eliminating QuickBooks error PS077, the issue can be severe. Get quick consultations from experienced professionals by dialing +1-(855)-955-1942 ASAP!! They will analyze the situation and offer all the help you need to resolve the PS077 error in QuickBooks Desktop.

Frequently Asked Questions

A. QuickBooks Error PS077 is a payroll update error that occurs when users try to download or install the latest payroll updates. It usually happens if the payroll subscription is inactive, the QuickBooks software is outdated, or there is corruption in company files.

A. This error typically appears if your payroll subscription is not registered correctly, the billing information is invalid, or QuickBooks cannot connect to Intuit’s servers. Damaged program files or incomplete installation may also trigger it repeatedly.

A. To resolve QuickBooks Error PS077, first make sure your QuickBooks software is updated to the latest release. Verify and revalidate your payroll subscription, update billing information, and run the QuickBooks Tool Hub to repair data issues.

A. Yes, if Error PS077 is not fixed, you may not be able to download payroll tax table updates. This can cause inaccurate payroll calculations, incorrect tax filings, and potential compliance issues with federal or state regulations.