Every QuickBooks user wants to maintain accurate financial records related to business operations. One key aspect is that many customers do not pay invoices, and in such cases, you need to write off bad debts in QuickBooks. This is necessary if you desire your net income and accounts receivables to stay up-to-date. In this guide, we will explore the relevant process through which you can remove bad debts in QB Online and QB Desktop.

Writing off bad debt in QB Desktop and Online involves creating an expense account. This expense account helps you track bad debt and ensure that you are always able to balance your accounts. Moreover, managing bad debts allows you to reduce accounting errors and stay compliant with standard accounting practices.

Alright, then, let’s navigate through the article to learn how you can seamlessly settle bad debts in QuickBooks.

Incorrectly writing bad debts can directly impact a company’s financial statements and total income. Therefore, to avoid this, you must get in touch with an accounting expert at +1(855)955-1942 and let them handle this task on your behalf.

Use These Steps to Write Off Bad Debt in QuickBooks Online

The process to write off bad debt in QuickBooks Online includes examining your account receivable aging report and then generating bad debt items under a bad debt account, followed by the steps to write it off.

Step I: Review Account Receivable Aging Detail Report

Using the Accounts Receivable Aging Detail report, review invoices or receivables that should be considered bad debt so that you can write them off later on.

- Go to the Reports menu at the top.

- Look for the Accounts Receivable Aging Detail report and open it.

- Examine which outstanding accounts receivables should be written off.

Step II: Create an Account For Bad Debts Expense

If you haven’t already, you should create a separate bad debt expense account in your QuickBooks Online to keep all the bad debt items organized in one place.

- Click the Settings icon from the right pane of your screen and then choose Chart of Accounts.

- Select New in the upper right corner to create a new account.

- From the Account Type dropdown, choose Expense.

- Further, select Bad Debts from the Detail Type dropdown.

- Enter Bad debts in the Name field.

- Finally, click Save and Close to save these changes.

Step III: Create an Item for Bad Debt

To balance the accounting, create a non-inventory item as a placeholder for the bad debt. Follow the below steps to create this unreal item.

- Go to Settings and then choose Products & Services.

- From the upper right corner, select New and then click on Non-inventory.

- Enter Bad debts in the Name field.

- Choose Bad Debts from the Income account dropdown .

- Lastly, click Save and Close.

Step IV: Create a Bad Debt Credit Memo

After creating the non-inventory item for bad debts, you need to create a credit memo for them.

- To create a new Credit Memo, click +New.

- Choose the Credit Memo option and then select a customer from the Customer dropdown menu.

- Move to the Product/Service section and then choose Bad Debts.

- Further, enter the amount you wish to write off in the Amount column.

- In the Message displayed on the statement box, write Bad Debts.

- Finally, click Save and Close to save these changes.

Step V: Apply the Credit Memo to the Invoices

After creating the credit memo, we need to apply them to the bad debt invoices; here’s how to do it.

- Click +New and then select Receive Payment under Customers.

- Choose an appropriate customer from the Customer dropdown menu.

- From the Outstanding Transactions section, choose the bad debt invoice.

- Select a credit memo from the Credits section.

- Now, click Save and Close.

After applying the credit memo to the invoices, the uncollectible receivable will now appear in your Profit and Loss report section under the Bad Debts expense account.

Step VI: Run a Report for Bad Debts

Finally, you need to run an Account Quick Report to review all the receivables you tagged as a bad debt. Follow the below steps to run the report.

- Go to Settings in the right corner of your screen and then choose Charts of Accounts.

- Move to the Action column of the bad debts account and select Run Report.

Note: You may distinguish a bad-debt entity from your other customers by adding a note to their name;

- Go to the Sales menu and then choose Customers.

- Choose the customer’s name for which you want to write the bad debt.

- Click Edit from the upper right corner.

- Enter Bad Debt or No Credit after the customer’s name In the Display Name as field.

- Finally, click Save.

Learn the Steps to Write Off Bad Debt in QuickBooks Desktop

Writing off bad debts in QuickBooks Desktop is easy as all you need to do is create an expense account to track bad debts and then close all the unpaid invoices. Let’s write off unrecoverable incomes by following the below steps:

Tip: With the Accounts Receivable Aging Detail report, you can keep track of your client’s open balances.

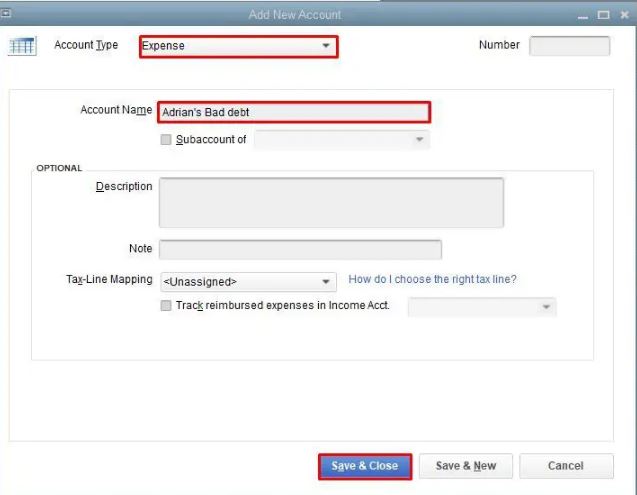

Step I: Add an Expense Account in Order to Track Bad Debts

To track bad debts, you first need to add an expense account to the Charts of Accounts; here’s how to do it.

- Go to the Lists menu at the top and then select Charts of Accounts.

- Choose the Account menu from the left pane and then click New.

- Further, select Expense and then click Continue.

- Enter an Account name such as Bad Debt.

- Finally, click Save and Close.

Step II: Close Out the Unpaid Invoices or Bad Debts

Let’s move out the bad debt from the current tab to label it as closed.

- Select Receive Payments from the Customer menu.

- In the Received From field, type the customer’s name.

- Type $0.00 in Payment Amount.

- Further, choose Discounts and Credits.

- Enter the amount you’d like to write off in the Amount of Discount field.

- Select the account you added in Step 1 for Discount Account and Click Done.

- Lastly, choose Save and Close.

Also Read: Quick Guide to Reconcile a Bank Account in QuickBooks

Utilize These Tips When Writing Off Bad Debt in QuickBooks

Here are some effective measures that will help you whenever you write off bad debt in QuickBooks:

- Verify the Debt is Truly Uncollectible: Ensure all collection efforts have been exhausted before writing off the balance.

- Use a Dedicated Bad Debt Expense Account: Set up a separate expense account to accurately track bad debt write-offs.

- Create a Credit Memo or Journal Entry: Use a credit memo in QuickBooks Online or a journal entry in Desktop to adjust the customer’s balance.

- Apply the Credit to the Open Invoice: Match the credit to the unpaid invoice to clear it from accounts receivable.

- Include Proper Descriptions: Add notes like “Bad Debt Write-Off” in the memo field for future reference and audit trails.

- Review Write-Offs Annually: Evaluate your bad debt trends yearly to adjust credit policies if needed.

Wrapping Up

In this exhaustive guide, we have discussed the step-by-step process to write off bad debt in QuickBooks Desktop and Online. Hopefully, you can now effortlessly manage bad debts and ensure precise financial records for your business. If, however, you still face any difficulties or have a query, you can reach out to a QB professional for real-time guidance.

Frequently Asked Questions

A. Writing off bad debt in QuickBooks means removing unpaid customer invoices from your accounts receivable when it becomes clear the customer won’t pay. Instead of keeping the overdue balance open, QuickBooks lets you record it as a bad debt expense. This helps maintain accurate financial reports, ensures your receivables reflect only collectible amounts, and gives a true picture of your company’s profitability. It also prevents inflated income reports that could affect tax filings and decision-making.

A. Writing off bad debt in QuickBooks is important because it keeps your books accurate and compliant. If you leave unpaid invoices open, your accounts receivable balance will look higher than it actually is, misleading you about cash flow and profitability. Recording bad debt properly ensures expenses are captured in the correct period, giving a realistic view of your business’s financial health. It also helps simplify year-end reporting and avoids overpayment of taxes on income you never received.

A. In certain editions, QuickBooks Accountant and QuickBooks Enterprise have features that allow batch write-offs. You can filter by aging, select multiple customers, and write off all qualifying invoices in minutes — ideal for businesses with large A/R lists.