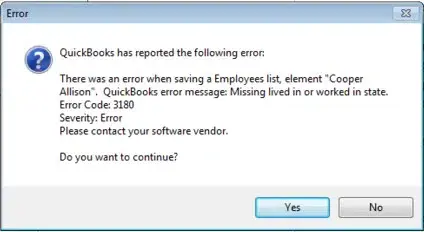

Encountering issues while carrying out the financial exchange between QuickBooks Desktop and QuickBooks POS (Point of Sale) can be frustrating, and one such difficulty you might come across is QuickBooks Error 3180. When this error occurs, you may see the following message on your screen:

| “There was an error when saving a Employees list, element “Employee, Name.” |

Once this problem appears, here’s what you might notice on your computer:

- QuickBooks fails to process sales receipts or transactions properly.

- The QB application may freeze or crash unexpectedly.

- Payroll processing and financial exchanges in QuickBooks Point of Sale (POS) may be disrupted.

The good news is that this challenge can be resolved efficiently using various troubleshooting methods. Alright, then, let’s explore the potential causes behind this error code and the most effective solutions to fix it.

If you want immediate help to fix QuickBooks error 3180, dial +1-(855)-955-1942 to contact a QB professional.

Understanding QuickBooks Desktop Error Message Code 3180

QuickBooks Error 3180 is a common issue that occurs when there are problems with sales tax details or vendor associations. This error typically arises when QuickBooks is unable to link sales tax items to a vendor, causing difficulties when saving transactions like sales receipts or credit memos. Some of the common messages that are associated with this problem are illustrated below:

| “There was an error when saving a Sales Receipt (or Credit Memo). Sales tax detail line must have a vendor.” |

| “ An error occurred while trying to save a sales receipt.” |

| “A problem arose while trying to save the General Journal Transaction.” |

| “The posting account seems invalid.” |

| “Sales tax detail line should always have a vendor.” |

| “A/P (or A/R) detail line must have a vendor.” |

To successfully troubleshoot this issue, it’s important to understand the factors that trigger it. Let’s navigate to the next section for that.

Why Do You Come Across QuickBooks Error Message Code 3180?

The QuickBooks Error 3180 occurs mainly due to some issue with the QB sales tax payable account. However, there can be other multifaceted reasons that can evoke the error in QuickBooks, which are given below:

- The sales tax item in your QuickBooks Desktop is not linked with any of the vendors.

- There are chances that the account mapping of the sales tax payable accounts may be incorrect.

- If a pay-out was created while using the sales payable account.

- It can occur because you are using the sales tax payable account as the target account for one or more items on receipts.

- There is any damaged or incorrect type of payment item on the list.

- It can occur if you have used the wrong type of QB Desktop account while mapping accounts in Quickbooks POS.

- The system’s antivirus or Firewall application can also cause this error.

Getting Error initializing QBPOS application log? Follow this detailed blog to resolve this issue.

Use 5 Essential Hacks to Eliminate QuickBooks Error 3180

Since Error 3180 in QB occurs due to multiple reasons, therefore to fix it, you need to verify each and everything that can trigger it. Follow the given methods to resolve QB Error 3180.

1. Merge Duplicate Payment Items in QB Desktop

- Open the QuickBooks desktop application and go to the List option.

- Here, you need to choose Include Inactive option.

- Next, you need to sort the list, so select the Type header.

- Now, Rename the Point of Sale payment items.

- Next, you need to click on the payment item that begins with Point of Sale.

- Choose Edit items and then add Old to its name.

- Then press OK.

- Now merge the duplicate items in the QB desktop.

- Then, click right on the payment method with Old.

- Edit the item and Remove the Old.

- Lastly, click Ok and choose Yes to confirm.

2. Assign the Vendor to the Sales Tax Item

- First, you have to open the QuickBooks Desktop application.

- Next, proceed to the Item List and opt for Include Inactive.

- Now, in order to sort the list, you need to opt for the Type Column option.

- Finally, you need to make sure that sales tax items have a tax agency attached to them.

3. Choose Your Tax Preferences in QB POS

- Initially, you need to run the QuickBooks Point of Sale.

- Next, go to the File option and there, choose the Preferences option.

- After that, you need to click on the Company option and hit on the Accounts under the Financial option.

- Next, tick on the Basic and Advanced tabs.

- Also, remember to tap on the Make Sales Tax Payable option in the sales tax row. In case it is not done, then change it and run a financial exchange.

4. Verify that the Receipt is Not Paid Out Using Sales Tax Payable

- Start with launching the QuickBooks Point of Sale.

- Next, you need to choose the Sales History option.

- Then, click right on any of the given columns.

- After that, you have to choose the Customise Columns option.

- Next, ensure to choose the QuickBooks Status.

- Then, you need to search for the Receipts which are not completed yet.

- Choose the Receipts if you find any of the receipts that are not paid out to the Sales tax payable.

- After that, click on the Reverse Receipt option.

- Now, tap on Recreate the paid out by using a non-sales tax payable account.

- Lastly, run the financial exchange to check for QuickBooks Error 3180.

5. Rename the Payment Methods

- To start with the troubleshooting, launch the QB Desktop application.

- Then head to the Lists heading and choose the Customer & Vendor Profile Lists options under it.

- Next, choose the Payment Method List there.

- Now, hit click right on the Cash method option and choose Edit payment method.

- Remember that now the payment method field should have the letter “X” at the beginning. If it does, save your modifications.

- After that, you need to right-click on the Cash methods and opt for a New option.

- Then, replace it by renaming it to Cash.

- Again, begin with the Financial exchange.

- Now, change the name of all the payment options if required.

- Then check for QuickBooks Error 3180.

Utilize These Crucial Tips to Prevent QuickBooks Error 3180

Here are some really beneficial measures that you can implement to prevent QuickBooks error 3180:

- Ensure Proper Sales Tax Vendor Association: Always link sales tax items to a vendor in QuickBooks to prevent transaction errors.

- Verify Account Mapping: Check that sales tax payable accounts are correctly mapped in QuickBooks and QuickBooks POS.

- Avoid Using Sales Tax Payable for Payouts: Do not use the sales tax payable account for payouts, as it can lead to errors in transaction processing.

- Regularly Update QuickBooks and POS: Keeping your software updated ensures compatibility and reduces the risk of errors.

- Review Payment Items List: Remove or correct any damaged or misconfigured payment items in the list to maintain transaction accuracy.

- Run Regular Data Integrity Checks: Use QuickBooks’ Verify and Rebuild Data tool to identify and fix potential file corruption.

- Enable Proper Tax Preferences: Make sure sales tax settings in QuickBooks Preferences are properly configured to avoid tax-related errors.

Wrapping Up

In this extensive article, we walked you through several tactics that you can easily implement to fix QuickBooks error 3180. Hopefully, you can now seamlessly carry out the financial exchange between QB and QuickBooks POS. If, however, you still face any issues or have a query, you can contact a QB professional for real-time guidance.

Frequently Asked Questions

Here’s why you might get QuickBooks error 3180 on your system:

1. Incorrect Sales Tax Settings: If sales tax items or accounts are incorrectly mapped, QuickBooks may fail to process transactions.

2. Issues with Receipt or Payment Transactions: Incomplete or improperly configured receipt/payment transactions can cause conflicts.

3. Duplicate Vendor or Customer Names: Having duplicate entries in the vendor or customer lists can create inconsistencies in financial records.

4. Unlinked Accounts in QuickBooks POS: If accounts in QuickBooks Point of Sale (POS) are not properly linked to QuickBooks Desktop, syncing issues may arise.

5. Corrupt QuickBooks Installation: A faulty or incomplete installation of QuickBooks can lead to multiple problems.

6. Permission Issues: Insufficient user permissions may restrict access to certain files or transactions, causing errors.

Yes, interference by third-party applications can trigger QuickBooks error 3180. Some third-party apps, especially security software, may conflict with QuickBooks by modifying sales transactions incorrectly and blocking communication between QuickBooks and POS. To fix this issue, you must disable third-party apps.

While data inconsistency is the primary cause, outdated QuickBooks versions may increase the risk. Older builds may struggle with large inventory files or frequent sync operations, leading to repeated errors.