Properly managing fixed assets is crucial for accurate financial reporting and tax preparation for every business. In recent times, most enterprises have started to manage fixed assets in QuickBooks by using Fixed Assets Manager (FAM). QuickBooks offers efficient solutions for recording, organizing, and maintaining your fixed assets—like equipment, vehicles, and property. In this guide, we’ll explore how to manage fixed assets within QuickBooks using a proven step-by-step process.

Before managing fixed assets, you must also learn how to record them in your books. The process to do so is straightforward. Moreover, you should learn how to correctly configure the FAM in your software. You will discover all these details in this extensive article.

Alright, then, let’s move into the blog to find how to setup and manage fixed assets in QB Desktop.

Learn How to Record a Purchase of Fixed Assets in QuickBooks

Before you actually manage fixed assets in QuickBooks, you need to know how to record them in your books so that the application does not mix them with your normal purchases. Let’s look at the steps you need to follow:-

- Tap on the menu tab and select List. Then choose Fixed Asset Item List.

- Click on the Item button present in the lower-left corner of the list window and from the pop-up menu, select New. There will be Asset Name/Number field and enter the required details.

- Select the asset account to be used while tracking the value of the asset from the Asset Account drop-down menu.

- Select the option to specify whether the item is new or used in the “Purchase Information” column. Enter the date you purchased the item in the “Date” field.

- Use the “Asset Description” field in the “Asset Information” section to describe the item.

- Tap on OK to save the information you entered and close the New item Window.

Now, Fixed Asset Manager in QuickBooks desktop application can depreciate the item as per the selected standard if you have already set up Fixed Asset Manager.

Steps to Setup Fixed Asset Manager in QuickBooks Desktop

Data files for Fixed Asset manager and QuickBooks desktop are different. Therefore, you are required to set up Fixed Asset Manager in QuickBooks to manage your financial information correctly. Execute the below mentioned process:

Step I: Organize the Income Tax Form

FAM (Fixed Asset Manager) cannot track your asset depreciation until you set up your income tax form. For someone who is setting up a new company file need to follow different steps from someone who already has a data file.

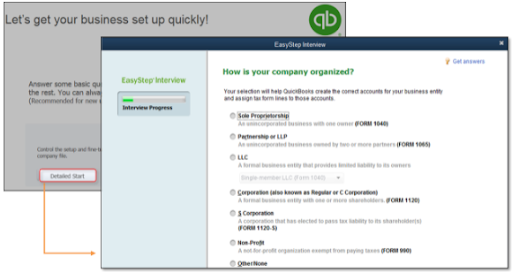

Type A: Setting up Tax Form in a New Company File

The process to set up a tax form in the starting will require you to enter the detailed information:

- In the No Company Open window, click on Create a new company and then Detailed Start.

- In the Easy Step Interview, How is your company organised? Window you need to choose the income tax form.

- Now, enter the required information and complete the process of creating a company file.

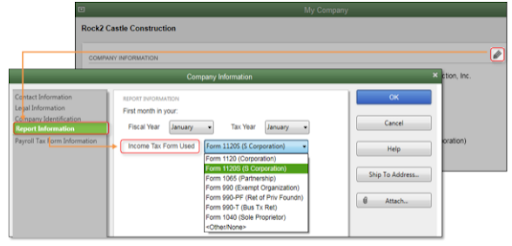

Type B: Setting up Tax Form in an Existing Company File:

If you have been using a company file for a while and are setting up a tax form in order to manage fixed assets in QuickBooks, you need to choose an income tax form based on your business.

- Go to My company from Company menu.

- Tap on Pencil Icon and select Report Information.

- Select the income tax form suitable for your business and choose OK.

Also See: QuickBooks Balance Sheet Out Of Balance! Here’s What To Do

Step II: Create a General Ledger (G/L) Account

QuickBooks provides you with 2 options for managing fixed assets. You can select either a Minimal account configuration with a limited number of accounts or an Ideal account setup with unique accounts established up each fixed asset.

| ACCOUNT NAME | TYPE |

| Fixed Asset Account | Fixed Asset |

| Accumulated Depreciation Account | Fixed Asset |

| Depreciation Expense Account | Expense |

Ideal Account Setup in Charts of Accounts (CoA)

You need to have a different account for different fixed assets or a group of assets with the same depreciation levels. You will also have to add two subaccounts for every fixed asset account you created. Let’s look at the steps you need to follow:

- Create a Fixed Asset account for all your fixed asset (or a group of assets) that will depreciate over time, such as vehicles, computers, or furniture.

- Click on Chart of Accounts.

- Right-click anywhere on your screen and click on New.

- Select Fixed Asset and fill in the information that is required.

- Tap on Save & Close.

- The proper way to manage fixed assets in the QuickBooks account is by creating two subaccounts. The cost of the asset will be tracked in one account, and the accumulated depreciation will be tracked in the other. You’ll be able to tell the book value and accumulated depreciation of your asset at a look if you do it this way.

- Click on Chart of Accounts.

- Right Click anywhere and choose New.

- Select Fixed Asset and tick mark Subaccount of. Select the correct parent account.

- Enter all the required information.

- Tap on Save & Close

- Create a Depreciation expense account to keep track of your depreciation costs.

- Click on Chart of Accounts again and right-click anywhere.

- Tap on New and select Expense. You need to enter all the required information.

- Tap on Save & Close.

Fixed Asset Manager in QuickBooks desktop records depreciation in Depreciation (Expense) account as well as another entry in the Accumulated Depreciation account. You need to have a specific General Journal (G/L) account created before you use FAM for the first time.

Step III: FAM Client Wizard

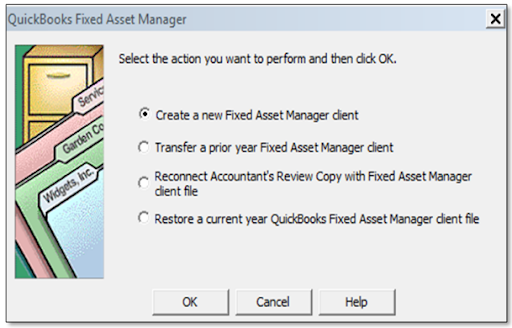

In order to run fixed asset manager in QuickBooks desktop from the Accountant menu, tap on Manage Fixed Asset and select the option best suitable for you:

- Create a new Fixed Asset Manager client: You need to choose this if you are a first-time user.

- Transfer a prior year Fixed Asset Manager client: This option is highly recommended for users that are returning and want to bring last year’s assets into this year’s FAM.

- Reconnect Accountant’s Review Copy with Fixed Asset Manager: This option helps in bringing in the current year’s assets into the company file.

- Restore a current year QuickBooks Fixed Asset Manager Client file: This option is highly useful for users that have generated back up for fixed asset manager in QuickBooks. It allows those files to be restored.

IMPORTANT: Don’t mistake Backup Fixed Asset Manager in QuickBooks to be the same as Company backup file as FAM backup is done within FAM program

Fixed Asset Manager Client Wizard

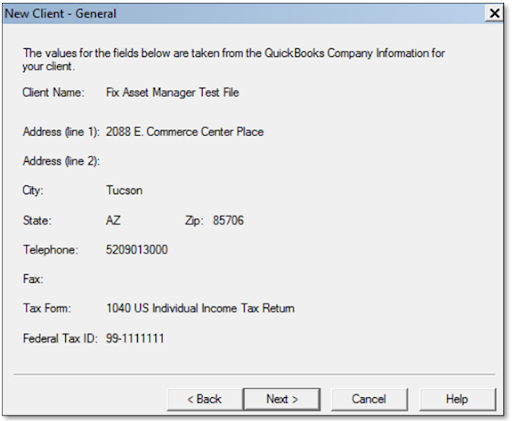

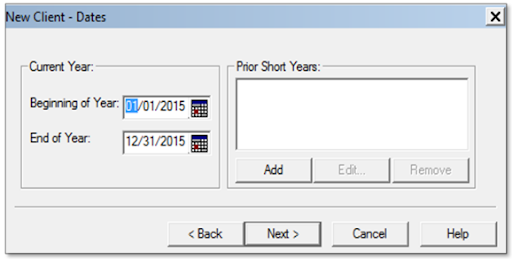

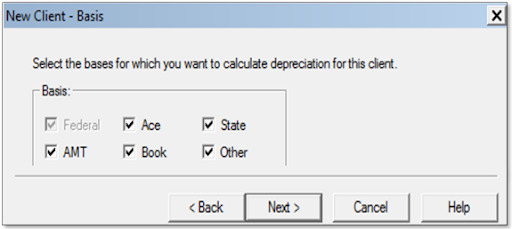

There are different windows that represent different data for users. They allow you to make changes as well as decide how you want to calculate your depreciation:

- General: This window shows the basic information about the QuickBooks Desktop file.

- Dates: The computations and reports generated by the fixed asset manager in the QuickBooks desktop are based on a certain time frame. Select the current year’s start and end dates to prepare financial statements. When an asset is loaded into FAM, the program uses these dates to automatically calculate past year depreciation. Values from the client’s current depreciation schedules can be used to override these values. Users should follow the year-end procedures at the end of this time period.

- Basis: You can choose which tabs appear in the bottom half of the Asset screen on this screen.

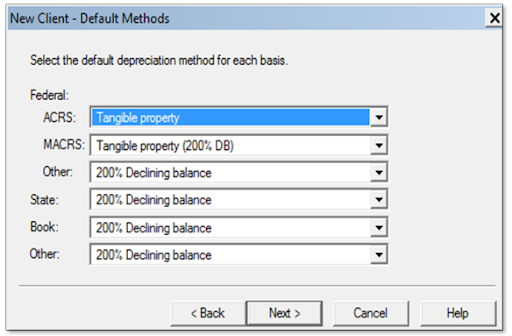

- Methods: You can choose the default procedures for newly created assets on this screen.

NOTE: To save time when inputting new assets, select the most frequently used options for your personal accounting practice.

- Synchronization (From/To) : This panel lets you manage data transfer between FAM and QuickBooks Desktop.

Step IV: Adding Assets in Fixed Asset Manager

Follow the instructions in this section if you did not set up your fixed asset accounts in QuickBooks Desktop or if you chose to move the information from FAM to QuickBooks Desktop. Information from your QuickBooks Desktop company file will be automatically transferred when you first set up your FAM. The two applications will continue to sync depending on the sync setup you pick on your FAM.

- Add an asset to FAM:

- Choose Add from the toolbar.

- Select F4 from your keyboard, or

- Tap on Add Asset from the Asset menu.

- After you’ve added the asset, use the top section to fill in details like the description, the federal form for reporting depreciation, and the general ledger accounts you set up in QuickBooks Desktop.

- Add depreciation calculation information, such as cost, tax system, and depreciation method, to the lower part.

Step V: Asset Synchronization

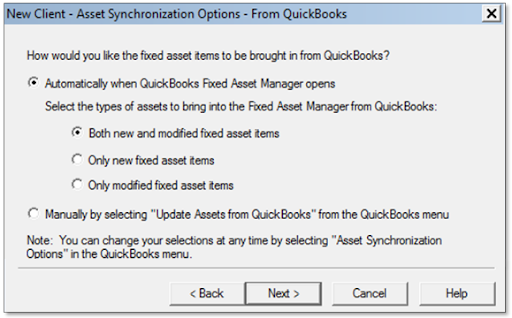

QuickBooks Desktop and FAM have 2 different files however you can sync two programs either through Automatic or Manual sync.

Automatic Synchronization

- Select Asset Synchronization Options from FAM QuickBooks.

- Tap on From QuickBooks tab and choose Automatically when QuickBooks Fixed Asset Manager opens and Both new and modified fixed asset items.

- Click on OK to close Fixed Asset Manager in order to refresh the program.

Manual Synchronization

- Select Asset Synchronization Options from FAM QuickBooks menu.

- Tap on From QuickBooks tab and select Manually by Selecting “Update Assets from QuickBooks” in the QuickBooks menu.

- Under the QuickBooks tab choose Manually by selecting “Save Assets to QuickBooks” from the QuickBooks menu.

- Tap on OK and close Fixed Asset Managers to refresh the program and make manual synching available.

- Now run Fixed Asset manager again.

- From the FAM QuickBooks menu, select Update Assets from QuickBooks or Save Assets to QuickBooks to sync information.

How Should You Back Up the Fixed Asset Manager in QuickBooks?

The process to backup fixed asset manager is QuickBooks is important as you need to have a safe record of your data. The steps that you need to follow are:

- Run QuickBooks Fixed Asset Manager

- Tap on the File menu and select File Maintenance.

- Then click on Copy Files and choose Clients.

- Select C:\FamWinYY\Clients folder under Directory.

- Select client files that you want to backup from the Client Name section.

- Tap on OK.

- Click on the folder button and select the folder you want to back up the clients to.

- You can type in a path to a folder you want to create if you haven’t already done so, such as C:\FamWinYY\Backup

- Untick the Compress client files box.

- Tap on OK.

Follow These Tips When Managing Fixed Assets in QuickBooks

Here are some tips you can follow when managing fixed assets in QB Desktop:

- Create a Fixed Asset Account: Set up specific asset accounts in your Chart of Accounts for each category.

- Use the Fixed Asset Manager (FAM): Utilize the Fixed Asset Manager tool to track depreciation and generate reports.

- Record Asset Purchases Accurately: Enter detailed info like purchase date, cost, vendor, and useful life.

- Assign Unique Identifiers: Use item names, serial numbers, or asset tags to avoid confusion and ensure easy tracking.

- Track Depreciation Regularly: Set up depreciation schedules to reflect asset value over time correctly.

- Link Assets to Vendors: Keep vendor info tied to each asset for easy warranty, service, or support tracking.

Conclusion

In this guide, we showed how you can easily manage fixed assets in QuickBooks using Fixed Assets Manager. Hopefully, you can now seamlessly setup and manage fixed assets in QB Desktop. If, however, you want further guidance or have a query, you can contact a QB professional +1(855)-955-1942.

Frequently Asked Questions

Fixed assets are long-term items your business owns—like vehicles, equipment, or property—that are used to generate income and are not quickly consumed or sold.

You can add a fixed asset by creating a new account in the Chart of Accounts and recording the purchase as a fixed asset instead of an expense.

FAM is a tool in QuickBooks Desktop used to track, depreciate, and report on fixed assets with detailed asset lifecycle management features.