Several intricate problems can occasionally arise when you send QB payroll data or direct deposit paychecks. One such issue that might trouble you is QuickBooks error code 80010. This is a payroll connection error that usually appears on the screen with any of the following messages:

| “Payroll Service Server Error. Please try again later. If this problem persists, please contact Intuit .” |

Or

| “Payroll Connection Error.” |

Once you run into this problem, here’s what might happen on your computer:

- QuickBooks may respond sluggishly to your commands & it might abruptly close.

- The Windows operating system will work slower than usual. Additionally, you might face issues when opening third-party apps located on the computer.

- Your system might shut down without any prior message.

Fortunately, there are many methods that you can easily implement to resolve this issue. Alright, then, let’s explore the article to know about the common causes of this error & discover detailed troubleshooting hacks.

If you want immediate help to fix QuickBooks error code 80010, dial +1-(855)-955-1942 to contact a QB professional.

Why Do You Get 80010 Error When Sending QB Payroll Data?

Here are the points that mention the main factors that generally provoke QuickBooks error code 80010:

- You might be trying to send QB payroll data in multi-user mode, leading to issues when connecting to the server.

- A slow, unstable, or inconsistent Internet service connection to the computer can give way to this problem.

- You might not have installed QB updates, and thus, the software might become incompatible with Windows on your computer.

- Any defect in the Internet connection settings on your system can trigger internal difficulties when connecting to the Intuit server.

- A network time-out might hinder your system from connecting to the Intuit server, leading to this issue.

- You may not have updated the payroll tax tables, and thus, you might face problems when using the direct deposit feature.

- Invalid date and time settings on your computer might cause difficulties when Intuit server attempts to authenticate the payroll connection.

- The Internet security certificate on your computer might be invalid, eventually causing errors when connecting to online servers.

- Windows Firewall & other security software installed on the system might prevent access to online servers if they improperly deem the connection as a security threat.

- Malware attacks on system files might trigger internal problems when you run QuickBooks Desktop payroll.

Now that you are familiar with the common causes behind this problem, let’s navigate to the following section to discover how to resolve it.

9 Things You Must Do to Fix QuickBooks Error Code 80010

Here are some really effective resolutions that you can implement each time you run into QuickBooks error code 80010. Make sure that you utilize these fixes in the exact order as discussed below.

1. Reboot Your Computer

QB payroll connection problems can arise due to some internal issues on your system. Therefore, one of the best ways to fix the 80010 error code in QuickBooks is to restart your computer. Once you have reopened your system, you can effortlessly access QB payroll & send your payroll data and paychecks.

If, however, you still encounter QuickBooks error 80010, try the next solution.

2. Download QuickBooks Updates

You are very likely to experience problems when using the payroll service if you haven’t updated QB Desktop. When you download QB updates, you get the latest software improvements, such as bug fixes, new tools, and refined features. This helps you run the payroll service more effectively. Therefore, you must download QuickBooks updates on your computer. Once done, you can easily send payroll data using the software.

Do you still get QuickBooks error code 80010? If that’s the case, consider installing the latest payroll tax table updates as explained below.

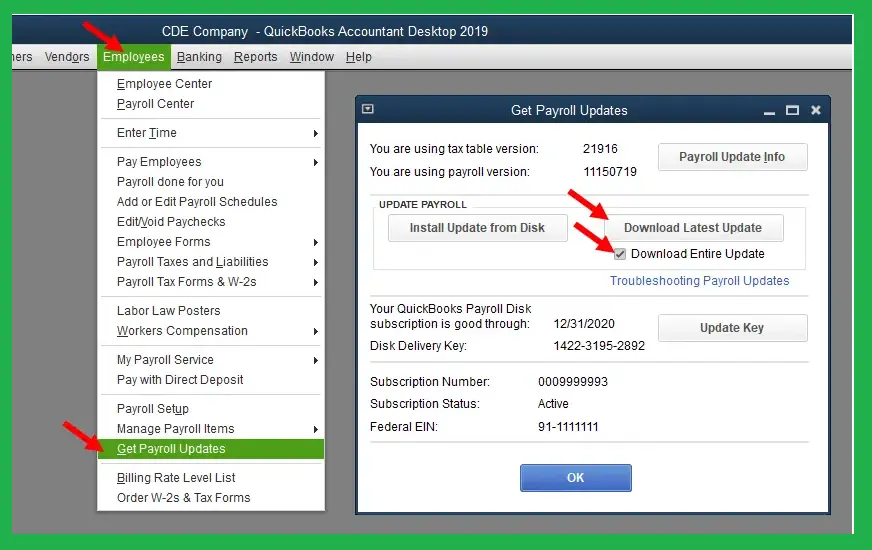

3. Install QB Payroll Tax Table Updates

Payroll tax table updates grant you the most recent tax calculation rates, tax forms, and fresh e-payment options. Once you install the latest payroll tax tables, you can easily utilize the direct deposit facility. Here’s what you need to do:

- Navigate to the Employees section and click Get Payroll Updates.

- Locate the number displayed next to ‘You are using the tax table version:’.

- Click Payroll Update Info for more information about your current tax table.

- At this step, you must click Download Entire Update.

- Click Update. A confirmation window will appear upon successful download.

If you continue to face QuickBooks error code 80010, consider using the single-user mode in the software as detailed below.

Also Read: How to Fix QuickBooks Payroll Update Error 15263

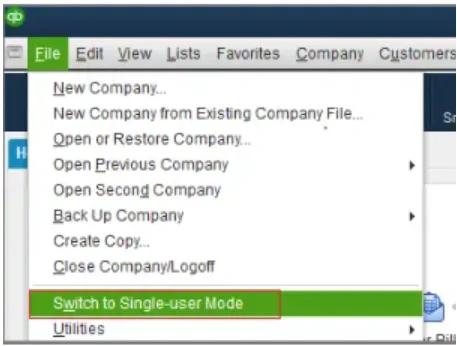

4. Run QB Desktop in Single-User Mode

Using QuickBooks in multi-user mode is one of the primary factors that trigger payroll connection issues. Therefore, it is essential that you operate QB in single-user mode when sending payroll data or utilizing the direct deposit facility. Here’s how you can do so:

- Open QuickBooks Desktop and go to the File menu.

- Select the Switch to Single-user Mode option displayed on the window.

- QuickBooks will then switch to single-user mode. Now, start using QB payroll for different tasks easily & effectively.

Do you still get QuickBooks error code 80010? If so, try checking your Internet speed, as illustrated below.

5. Review Your Internet Connection Speed

A slow and unstable Internet connection can trigger difficulties when you utilize QB payroll services. You should check the Internet speed using any speed test website, such as Cloudflare. If you note that your Internet speed is less than 10 Mbps, you must switch to a new Internet service provider that offers you a higher speed.

If, however, you encounter QuickBooks error code 80010 even after ensuring higher Internet speed, try checking system date & time settings as discussed below.

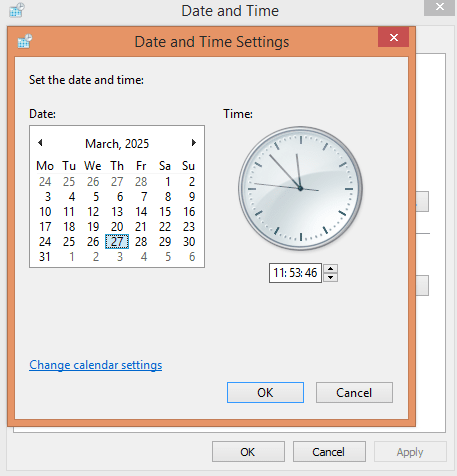

6. Verify the System Date & Time Settings

The incorrect system date & time settings might hinder you from sending payroll data because the Intuit server fails to authenticate the connection. Hence, you need to ensure that the date & time on your computer are accurate. Here’s what you can do:

- Locate the clock in the bottom-right corner of your screen.

- Right-click on the clock to open a small menu, and click on Adjust date/time. from the menu.

- A new Date and Time window will appear on the screen.

- Under the Date and Time tab, you will see the current system date and time.

- Click on the Change date and time… button.

- A new window titled Date and Time Settings will open.

- Click on the date field and select the correct date from the calendar.

- Click on the time field, and either type the correct time or use the up/down arrows to adjust it.

- Once done, click OK to save the changes.

- Finally, open QB Desktop payroll & send the payroll data successfully.

Do you still face QuickBooks error code 80010? If so, try reconfiguring Windows Firewall settings as detailed below.

7. Reorganize Windows Firewall Settings

Windows Firewall might cause problems when running payroll by restricting various QB programs from running on the system. This is because the Windows Firewall app incorrectly regards certain QB programs as a security threat. To fix this issue, you need to create exclusions for QB programs in Windows Firewall. Once done, you can seamlessly send QB payroll data.

If you find that the QuickBooks error code 80010 still persists, consider turning off the antivirus app as illustrated below.

8. Switch Off Your Antivirus App

The antivirus software might prevent you from sending payroll data by stopping several QB programs from running on the system. This happens because the antivirus app improperly identifies QB programs as a security threat. To resolve this glitch, you have to turn off the antivirus app on the computer. You will be able to run QB payroll easily for different tasks.

Do you still notice QuickBooks error code 80010? If so, consider repairing system files as discussed below.

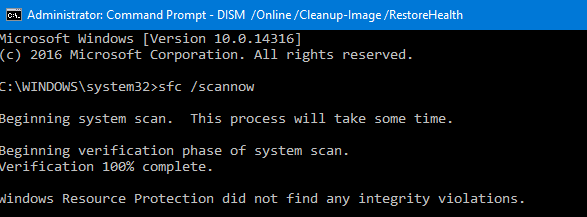

9. Repair Your System Files

Damage in different system files might provoke different internal problems when you try to send payroll data. The easiest way to scan & repair your system files is to run the System File Checker tool. This advanced utility will seamlessly scan and repair all system files.

Finally, you can successfully send QB payroll data & utilize the direct deposit facility.

Use These Tips to Prevent QB Payroll Connection Errors

Here are some helpful measures that you can implement to prevent QB Desktop payroll connection problems:

- Ensure a Stable Internet Connection: Use a wired connection or a strong Wi-Fi signal to prevent disruptions while sending payroll data.

- Verify System Date & Time Settings: Incorrect date/time can cause security certificate errors, blocking QuickBooks from connecting to Intuit’s servers.

- Disable Firewall & Security Software Temporarily: Firewalls or antivirus programs may block QuickBooks; allow QuickBooks through your security settings.

- Verify QuickBooks Payroll Subscription Status: Ensure your payroll subscription is active by checking Account & Settings in QuickBooks.

- Update QuickBooks Desktop & Payroll: Keeping QuickBooks updated ensures compatibility with Intuit’s latest security protocols.

- Check Intuit Server Status: Sometimes, Intuit’s servers may be down; check their status on the Intuit Status Page..

Wrapping Up

In this exhaustive guide, we showed you how you can easily resolve the QuickBooks error code 80010 using various methods. Hopefully, you can now seamlessly send payroll data & use the direct deposit facility. If, however, you still encounter problems or have a query, you should contact a QB professional for instant assistance.

Frequently Asked Questions

Here’s why you might face the QuickBooks error code 80010:

1. Missing or Corrupt System Files: Important system files required for QuickBooks operation may be missing or damaged, leading to this error.

2. Damaged QuickBooks Installation: A faulty or incomplete installation of QuickBooks can lead to various errors, including error 80010.

3. Conflict with Third-Party Applications: Antivirus software or other third-party applications may interfere with QuickBooks, causing the error.

4. Network Connectivity Issues: A weak or unstable network connection can disrupt communication between QuickBooks and the server.

5. Outdated QuickBooks Version: Running an outdated version of QuickBooks may cause compatibility issues and trigger this error.

6. Faulty Date & Time Settings: Inaccurate date & time on your system can trigger authenticate issues when connecting to the server.

To fix QuickBooks error code 80010, you need to do the following:

1. Check Internet Connection: Ensure you have a stable internet connection to access QuickBooks Payroll services.

2. Restart QuickBooks & System: Close QuickBooks, restart your computer, and relaunch QuickBooks to refresh connections.

3. Check Firewall & Security Settings: Ensure your firewall or antivirus isn’t blocking QuickBooks Payroll; add QuickBooks to the exception list.

4. Verify System Date & Time: Ensure your system’s date and time are correct, as discrepancies can cause connection errors.

5. Fix Your System Files: Use System File Checker to repair your system files & ensure that QB runs smoothly.

6. Reinstall QuickBooks: Reinstalling QB Desktop will refresh all files & folders, thereby allowing you to use payroll effectively.

Yes, corruption in system files can cause issues, such as 12000 error codes, when using QB Desktop payroll. This is because defective system files prevent QB program files from operating correctly on the computer. To fix this issue, you can use System File Checker to scan & repair your system files.