When you reconcile accounts in QuickBooks Online, you ensure that your records perfectly align with your official bank statements. Sometimes, however, problems can arise- maybe you entered an invalid transaction, or you reconciled an entry that you must not have done. In these scenarios, you need to undo bank reconciliation in QuickBooks Online. In this extensive guide, we will walk you through a step-by-step process of successfully undoing a reconciliation in QB Online (QBO).

There are several advantages that you can gain through undoing bank reconciliation in QBO. These include the prevention of errors, maintaining financial integrity, & avoiding issues with tax filings and audits. Another thing to note is that the process of undoing QBO bank reconciliation is quite simple & effective.

Alright, then, let’s explore the article to understand how you can seamlessly undo bank reconciliation in QB Online.

If you want immediate help while undoing bank reconciliation in QB Online, dial +1-(855)-955-1942 to contact a QB professional.

Easy Steps to Undo Bank Reconciliation in QuickBooks Online

The process to undo bank reconciliation in QB Online depends on the software version that you currently utilize on your computer. To elaborate, you must know that the steps to undo bank reconciliation are different for QB Online Accountant (QBOA) and other regular QBO versions.

Below are the points that explain various processes to undo bank reconciliation in QBOA and other regular QBO versions. Ensure that you implement these processes in the exact sequence as shown here.

1. Undo Bank Reconciliation in QB Online Accountant

If you utilize QB Online Accountant (QBOA) to manage your financial records or if you employ any professional accountant for the same purpose, you should follow the steps detailed below to undo bank reconciliation:

Step I: Prepare For Undoing the Bank Reconciliation in QBOA

Before you proceed forward to undo bank reconciliation in QBOA, you need to do the following:

- Firstly, you must download all attachments linked to the reconciliation. This is necessary because when you undo a reconciliation, all existing attachments are erased.

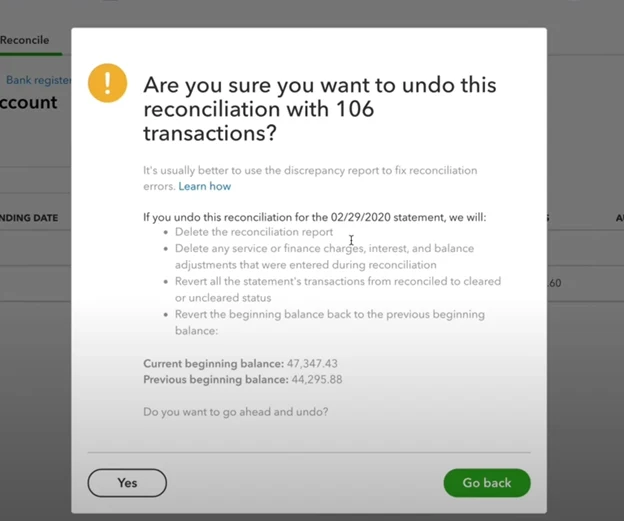

- Undoing a reconciliation also undoes all the reconciliations that follow in the software. For example, if it is May and you undo February’s reconciliation, then you will also undo March and April reconciliations. Eventually, various errors might appear on the screen. To overcome this difficulty, you must begin with the most recent reconciliation & proceed in reverse order.

- You won’t be able to undo reconciliations on manually recorded transactions. The transaction audit history will help you discover those transactions that might have been recorded manually.

Now, let’s jump to the following step to learn how to undo QBOA bank reconciliation.

Step II: Undo Bank Reconciliation in QBOA

Here’s how you can undo bank reconciliation in QBOA:

- Firstly, log into the QB Online Accountant on your system.

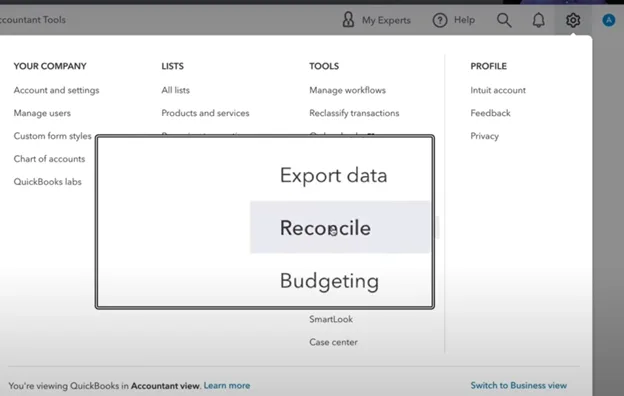

- Open the QBOA company file and move to the Transactions tab. After that, you have to choose the Reconcile option.

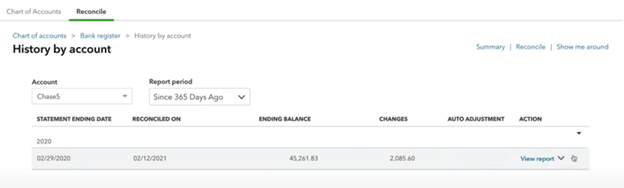

- Click on History by Account & choose the desired account and date range from the dropdown menus.

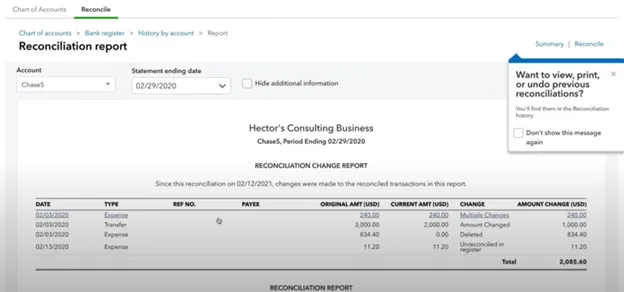

- Locate the reconciliation in the list and click View Report to open the Reconciliation Report.

- Review any discrepancies and the changes that you need to make.

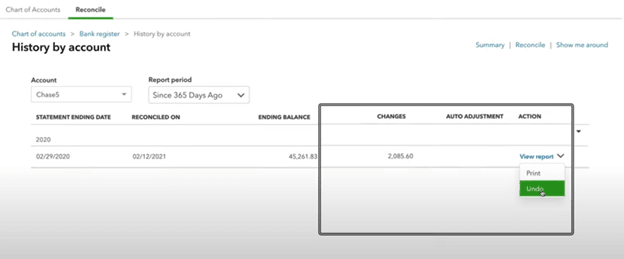

- When ready, click the dropdown ▼ in the Action column and select Undo.

- Confirm by selecting Yes, then click Undo again.

Now that you know how to undo bank reconciliation in QB Online Accountant, let’s go to the next section to find out how to do the same in regular QBO versions.

Also Read: Reconcile Bank Account in QB Online & Desktop

2. Undo Bank Reconciliation in Regular QB Online Versions

To undo bank reconciliation in regular QB Online editions, you need to follow these points:

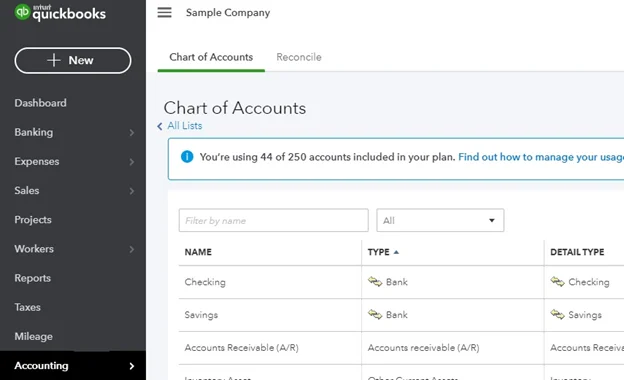

- Navigate to the Accounting menu and select the Chart of Accounts.

- Locate the desired account and click View register.

- To streamline your review, filter the register to display transactions from the last 60 days.

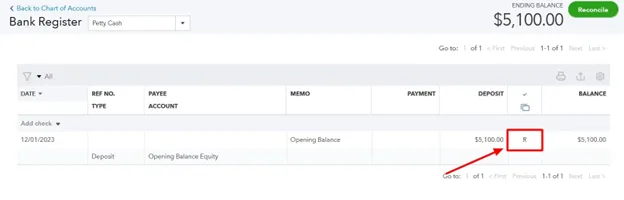

- Check the Reconciliation column—transactions that are reconciled will have an ‘R’.

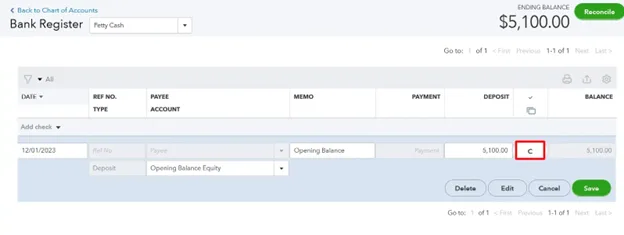

- Click the box repeatedly until it is blank to remove the transaction from reconciliation. The ‘C’ denotes a cleared transaction.

- Click Save, then close the register.

Finally, you can start running QB Online to finish different tasks easily & effectively.

Use These Exclusive Tips When Undoing Reconciliation in QBO

Here are some really helpful measures that you can follow when you undo bank reconciliation in QB Online:

- Review the Reconciliation Report First: Before making changes, check the report to identify discrepancies and understand what needs correcting.

- Start with the Most Recent Reconciliation: Work backward to avoid disrupting previously corrected records.

- Check for Duplicate or Missing Transactions: Ensure all transactions are correctly recorded and avoid reconciling duplicates.

- Keep a Backup or Record of Changes: Document the adjustments to track corrections and maintain a backup of QBO data.

- Consult an Accountant if Unsure: If you’re dealing with complex transactions, seek professional guidance to avoid errors.

Wrapping Up

In this comprehensive guide, we showed you how you can seamlessly undo bank reconciliation in QuickBooks Online. Hopefully, you can now ensure accurate bank records in your QB Online application. If, however, you need further guidance or have a query, you can reach out to an experienced QB professional.

Frequently Asked Questions

A. Undoing a bank reconciliation in QuickBooks Online means reversing or correcting a previously completed reconciliation process. Sometimes users reconcile the wrong transactions, use incorrect opening balances, or face duplicate entries that throw off their accounts. In such cases, you can undo or fix the reconciliation to align your books with the actual bank statement. Unlike QuickBooks Desktop, QuickBooks Online does not have a direct “Undo” button, but you can manually unreconcile transactions or ask your accountant to undo the entire reconciliation.

A. Yes, but with limitations. In QuickBooks Online, regular users cannot fully undo an entire reconciliation in one click. Instead, you can unreconcile individual transactions by removing the reconciliation checkmark. However, if you need to undo a whole reconciliation for a specific month, only users with Accountant access can perform that action. If you don’t have accountant access, you may need to contact your bookkeeper or accountant to properly undo the reconciliation.

A. Common reasons include:

a. Accidentally reconciling the wrong transactions.

b. Discovering duplicate entries after reconciliation.

c. Using incorrect opening or ending balances.

d. Identifying bank errors that weren’t visible earlier.

e. Adjusting for missing or uncleared transactions.

Undoing the reconciliation ensures that your financial reports, bank balance, and QuickBooks register stay accurate. If errors aren’t corrected, it can cause discrepancies in financial reporting, taxes, and cash flow management.

A. If you don’t have accountant access, you can’t undo the entire reconciliation in one step. Instead, you need to manually unreconcile transactions:

a. Go to the Accounting menu and select Chart of Accounts.

b. Locate the bank account and click View register.

c. Find the reconciled transaction you want to change.

d. Remove the “R” (reconciled) status by clicking on it until it’s blank.

e. Save your changes.

This removes the transaction from the reconciliation. However, you’ll need to repeat this process for every transaction if undoing a full month.